In today’s financial ecosystem, having a solid credit history is not a luxury, it’s a necessity. It acts as a financial passport, opening doors to vital opportunities like getting a loan, renting an apartment, or even securing a job. However, for ‘credit invisibles’ – those who are new to the world of credit – figuring out where and how to start can be a daunting task. Luckily, there are several paths available that can lead to a strong credit profile. This article will guide you through the process of building credit from scratch, even if you have no initial credit history.

Understanding the Importance of Credit

Before diving into the strategies for building credit, it’s crucial to understand why establishing a good credit history is important. A credit history is a record of how you’ve managed and repaid your debts. It’s used by lenders, landlords, and sometimes employers to assess your financial reliability. If you have a solid credit history, it signals that you’re a dependable borrower, which can:

- Improve your chances of getting approved for loans and credit cards

- Secure better interest rates

- Help you rent an apartment without a hefty security deposit

- Lower your car insurance premiums

- Make it easier to get a job, especially in a financial role

Moreover, good credit can give you financial flexibility and peace of mind, knowing you’re prepared for life’s unexpected expenses.

Understanding Credit Score

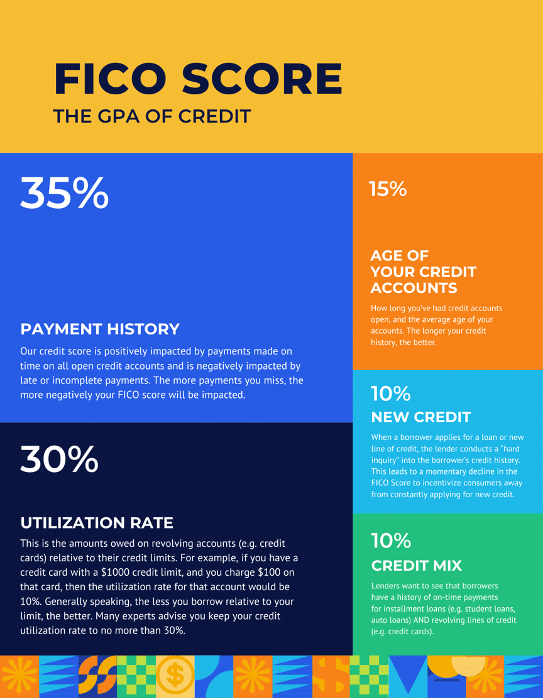

A credit score is a three-digit number generated by credit bureaus, which serves as a numerical summary of your credit history. It ranges from 300 to 850, where a higher score indicates less risk to the lender. While different credit scoring models exist, most lenders use the FICO or VantageScore models.

The components of a credit score include:

● Payment History: This is the most important factor. It shows if you’ve made your credit payments on time.

● Credit Utilization: It’s the ratio of your current total credit card balances to your total credit card limits.

● Length of Credit History: The longer your credit history, the better it is for your score.

● Credit Mix: It reflects the different types of credit you have, such as credit cards, student loans, or a mortgage.

● New Credit: It considers how many new accounts you’ve opened and how many recent hard inquiries you have.

Starting Your Credit Journey: Tips and Strategies

Establishing credit when you have none is a bit of a paradox – you need credit to build credit. However, there are several strategies you can employ to make this journey smoother.

1. Becoming an Authorized User

One of the easiest ways to start building credit is by becoming an authorized user on someone else’s credit card, usually a family member or a close friend. As an authorized user, you’ll get a card linked to the primary account holder’s credit account, and their payment history will reflect on your credit report.

However, this method requires careful consideration. It’s important that the primary cardholder has a good payment history and low credit utilization. If the primary cardholder misses payments or maxes out their credit, it could negatively impact your credit score. Learn more about this here.

2. Applying for a Secured Credit Card

Secured credit cards are another accessible option for those with no credit history. These cards require an upfront deposit, which typically serves as your credit limit. After making regular on-time payments for several months, you may be able to upgrade to an unsecured card and get your deposit back.

3. Using a Credit-Building Debit Card

Some financial institutions offer special debit cards that can help you build a credit history without going into debt. For example, Experian’s Smart Money digital checking account links to Experian Boost, which gives you credit for eligible bill payments.

4. Applying for a Credit-Builder Loan

Credit-builder loans are a type of installment loan designed to help you establish a positive payment history. Unlike traditional loans, the lender puts your loan payments into a savings account. Once the loan term ends, you get your money back, which helps build savings while establishing credit.

5. Applying for a No Credit Check Loan

No credit check loans are a type of loan that doesn’t require credit history. Making timely payments on a no credit check loan can help you to demonstrate your creditworthiness and positively impact your credit profile over time.

However, because no credit check loans can sometimes be costly and result in an adverse credit outcome, it is important to do your homework and ensure that it aligns with your overall financial goals before diving in. This TimesUnion article is a great resource to learn more about the overall cost of this particular credit building solution.

6. Applying for a Store Card

Store credit cards can be easier to qualify for and can help you build credit. However, they often come with high-interest rates, so it’s important to pay off your balance in full each month to avoid interest charges.

7. Reporting Rent and Utility Payments

Usually, rent and utility payments aren’t reported to credit bureaus, but you can use rent-reporting services to get these payments included in your credit file. This can be an effective way to build credit if you regularly pay these bills on time.

8. Using Alternative Credit-Building Services

Some services help people with no credit history establish credit by reporting payments for everyday bills. For example, Experian Go is a program that lets you create a credit report and start building credit. To learn more about this stellar credit building opportunity and how it works, check out How Experian Go Works.

Building Credit Takes Time and Discipline

Building credit from scratch isn’t an overnight process. It requires patience, discipline, and a commitment to good financial habits. Here are some tips for maintaining and improving your credit over time:

● Make payments on time: Payment history is the most crucial factor in your credit score. Always pay your bills on time to build a positive payment history.

● Keep balances low: Try to use only a small portion of your available credit. A lower credit utilization ratio can improve your credit score.

● Don’t apply for too much new credit: Each time you apply for credit, it results in a hard inquiry on your credit report, which can temporarily lower your credit score.

● Monitor your credit: Regularly check your credit reports for errors or signs of fraud. You’re entitled to a free credit report from each of the three major credit bureaus every year.

Remember, there’s no one-size-fits-all approach to building credit, and what works best for you depends on your personal and financial circumstances. However, by following these strategies and practicing good financial habits, you can build a robust credit profile that will help you achieve your financial goals.

Conclusion

Building credit from scratch may seem like a daunting task, but with the right approach and tools, it’s entirely achievable. By starting small, making payments on time, and slowly increasing your credit exposure, you can gradually build a strong credit profile. Remember, the journey to good credit is a marathon, not a sprint. Patience, consistency, and good financial habits are the keys to success!