In the world of cryptocurrencies, where the market never sleeps, the ability to automate trading becomes not just a convenience, but a necessity for many traders. Cryptorobotics offers the use of trading bots to optimize and improve the process of trading cryptocurrencies. This platform provides a unique set of tools that help traders maximize their profits and minimize risks, even when they are resting.

In this article, we will examine the key aspects of launching and managing a trading bot on the Cryptorobotics platform.

Overview of Key Features of Trading Bots on Cryptorobotics

The Cryptorobotics platform represents a solution in the field of automated cryptocurrency trading, offering users advanced trading bots. These bots have several key features that make them an integral part of successful trading in the fast-changing world of cryptocurrencies. Let’s consider some of these features:

- Algorithmic Trading: Cryptorobotics bots use complex algorithms to analyze market data and execute trading operations. This allows traders to benefit from market trends without the need to constantly monitor the market.

- Diversity of Strategies: The platform offers a range of preset trading strategies, including day trading, swing trading, and others, allowing users to choose the most suitable strategy depending on their trading style and market conditions.

- Custom Settings: Trading bots provide flexible settings, allowing traders to adapt algorithms according to their preferences.

- Risk Automation and Portfolio Management: Bots can automatically set Stop Loss and Take Profit levels, helping to manage risks and protect capital.

- Integration with Major Exchanges: Cryptorobotics supports integration with popular cryptocurrency exchanges, such as Binance, ByBit, and others, providing a wide range of trading opportunities.

- Ease of Use: The platform offers an intuitive interface that simplifies the process of setting up and managing bots even for beginner traders.

- Security and Confidentiality: Cryptorobotics places great emphasis on security, using advanced encryption methods and secure authentication to protect users’ data and funds.

- Analytical Tools: In addition to trading bots, the platform provides various analytical tools.

Types of Robots on the Cryptorobotics Platform

The Cryptorobotics platform offers traders various types of trading robots, each designed to meet diverse trading requirements and strategies. Here are some examples of the types of robots you can find on this platform:

Swing Trading Robots

Designed for longer time frames, these robots are better suited for traders looking to profit from significant market movements.

Robots Based on Technical Analysis

These robots use various technical analysis indicators, such as moving averages, RSI, or stochastic oscillators, to determine optimal entry and exit points for trades.

Hold Bots

They manage a set of cryptocurrencies, automatically rebalancing the portfolio in response to market condition changes.

Arbitrage Trading Robots

These robots look for and exploit price differences between different exchanges, allowing traders to profit from these temporary discrepancies.

News bots

They respond to market news and events, automatically executing trades based on their potential impact on the market.

Creating crypto bots from scratch

For more experienced users, Cryptorobotics offers the possibility of creating trading bots with individual strategies and parameters.

Setting up сrypto bots on the Cryptorobotics Platform

Setting up crypto bots on Cryptorobotics is a process that allows traders to fully utilize the potential of automated trading. Here are the main steps and recommendations for setting up crypto bots on this platform:

- Registration and Access to the Platform: Create an account on Cryptorobotics and log in. Ensure you have access to all necessary features and tools on the platform.

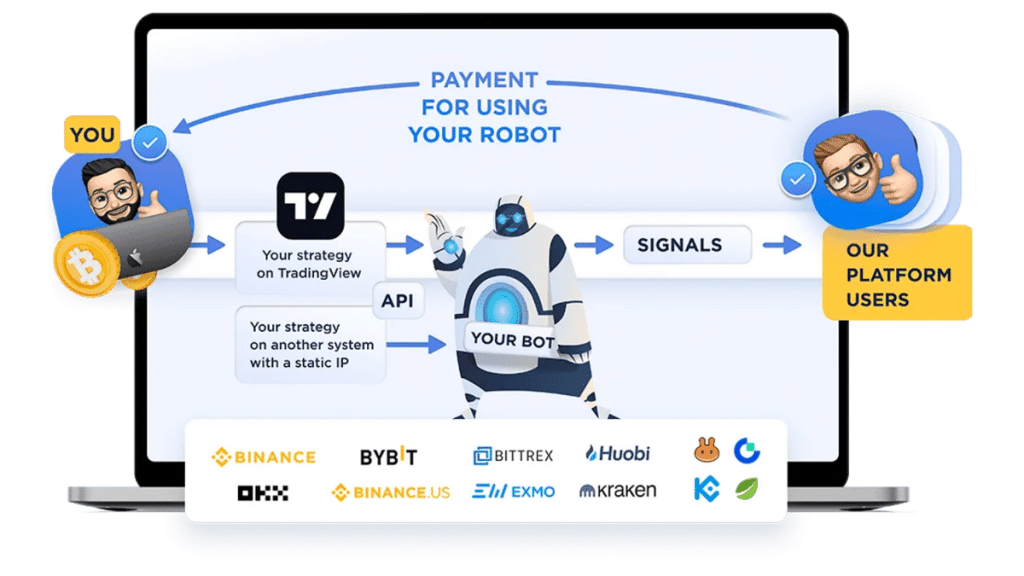

- Exchange Integration: To trade with a bot on Cryptorobotics, you need to link your account with an account on one of the supported exchanges via API. This ensures secure and efficient interaction between the platform and the exchange.

- Choosing the Right Robot: First, determine the type of robot that matches your trading strategy and goals. Various types of robots are available on Cryptorobotics, including scalping, swing, arbitrage, and others.

- Testing the Robot: Before launching the robot for real trading, it is recommended to test it in demo mode or with small volumes. This allows you to assess the effectiveness of the robot’s strategy and make necessary adjustments without the risk of significant losses.

- Setting Robot Parameters: Adjust the parameters of the trading robot according to your trading strategy. This may include selecting trading pairs, setting limits for Stop Loss and Take Profit, choosing a capital management strategy, and other settings.

- Monitoring and Optimization: After launching the robot, it is important to regularly monitor its performance and make adjustments to its settings as necessary. Market conditions constantly change, and adapting the robot’s strategy to current trends can improve trading results.

Conclusion

In conclusion, using trading robots on the Cryptorobotics platform opens up many opportunities in the world of cryptocurrency trading. The benefits of using this system are numerous: it automates complex trading strategies and allows working in the market 24/7. They can significantly improve trading results for both beginners and experienced traders.

With the ability to customize robots according to individual trading strategies and preferences, Cryptorobotics provides tools that help maximize profits and minimize risks.