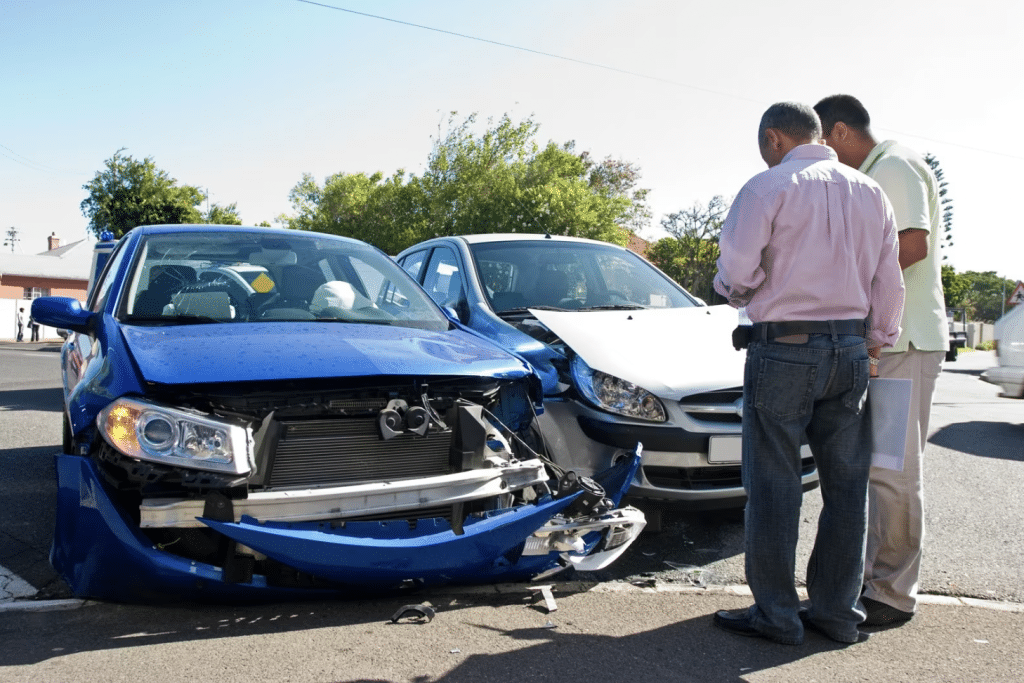

Car accidents are stressful events that may lead to fatalities, permanent physical damage, or a visit to the hospital with minor injuries. Additionally, dealing with your insurance company is another stressful result of a car accident.

Negotiating with your insurance company takes time and effort to get a fair valuation and indemnification. Also, it takes time before receiving the agreed-upon compensation amount in your bank account.

Here are ten tips to successfully negotiate with your insurer for fair compensation after a car accident.

Hire a Car Accident Lawyer

Hire a car accident lawyer if you need help negotiating with your insurer. They will help you to get the compensation you deserve from your insurance company.

Insurance companies have attorneys who negotiate settlement amounts with the insured. For a fair negotiation process, hire a lawyer.

Do not worry about paying your attorney. Car accident lawyers get paid from the proceeds of the settlement. You pay them a percentage of the compensation amount.

Hiring a lawyer ensures that your insurance company offers you a fair settlement amount.

Remember That The Insurance Company Is After A Profit Entity

Insurance companies promise financial compensation after a loss caused by an insurable event occurs. Car insurance is a legal requirement that allows you to claim indemnification after sustaining injuries from an accident or theft of your vehicle.

When going into negotiations, remember that insurance companies are after profit. They make their money from the premiums their customers pay. The more customers they have, the higher their revenues. The lower the amounts they pay out, the higher their profits.

Insurance companies work on the concept that the insured events are unlikely to occur to all their customers concurrently.

When you walk into an insurance company to negotiate compensation, you are causing them a loss. Consequently, they will offer a low settlement amount to keep their bottom line attractive.

Be ready to negotiate with them or their lawyers until they offer fair compensation.

Document Your Damages and Injuries

When preparing for negotiations with the insurance company, document all the damages and injuries you have suffered. Compile your medical bills, repair estimates, lost wages, and any other expenses or losses incurred due to the accident.

The more detailed and comprehensive your documentation is, the stronger your case will be when negotiating with the insurance company.

You will also require a police report of your accident before you start negotiations with your insurer.

If you are ever in a car accident, the first parties to call are the police, your insurer, family, and emergency services. A police report helps to establish the fault and cause of the accident. It will help you to negotiate a fair settlement with your insurance company.

A compensation demand letter and witness statements are other documents you need to negotiate with your insurer. Witness statements show the extent of your injuries and financial requirements after the accident.

Don’t Sign Anything Without Reviewing It

The insurance company may ask you to sign a release or settlement offer to resolve your claim. Before signing any documents, study them carefully and ensure you understand everything.

Insurance documents have lots of fine print that confuses many. Let the insurance company know if you have any concerns or questions. Or, consult a lawyer to help you understand the documents.

Be Professional and Polite

Maintain a professional and polite demeanor when negotiating with the insurance company. While it’s understandable that you may be frustrated or angry about the situation, getting into arguments or being aggressive will not help your case. Instead, focus on presenting your case calmly and rationally, and be prepared to provide evidence for your claims.

It helps to have a car accident lawyer represent you in the negotiations. All correspondence between you and your insurer will pass through your attorney. It will ensure the professional handling of the negotiation process.

Be Prepared to Negotiate

Negotiating with insurance companies is often a back-and-forth process. Don’t be discouraged if the insurance company initially offers you a low settlement or denies your claim outright. Instead, be prepared to negotiate and make counter-offers based on your documentation and the strength of your case.

Know When to Walk Away

While preparation for negotiation is essential, one should also know when to walk away from a bad deal. If the insurance company is unwilling to offer a fair settlement, or if you’re not comfortable with the terms of their offer, don’t be afraid to reject it and explore other options.

Keep Records of all Communications

Throughout the negotiation process, keep detailed records of all communications with the insurance company. Do not delete emails, record phone calls, and keep any other correspondence related to your claim.

Keeping thorough records can help ensure that you have evidence of the negotiation process you can use to provide valuable evidence if you need to escalate your claim in the future.

Be Patient

Negotiating with insurance companies takes time. Be patient and persistent in your negotiations, and do not give up if the insurance company quotes a low settlement amount.

You can increase your chances of receiving a fair settlement for your car accident case if you are not in a hurry to accept their offer.

Go to Court

You can sue your insurer for denying you a fair settlement. An experienced car accident attorney will help you win in court. They will help convince the judge and jury that your demand is reasonable, considering the accident’s impact on the quality of your life.

Also, court cases take six months to a year to conclude. Be patient and assist your attorney to ensure you win a favorable settlement.

Conclusion

When you are in an accident, you expect speedy assistance from your insurer. Often, they set up obstacles to the compensation you hope to get to ease your life and pay your medical bills. Follow these tips for a successful negotiation and a fair settlement from your insurance company.