It is almost a fantasy to delve into real estate investing with no capital to invest, yet many investors have begun this way. Instead of folly, it contains the key to unlock the field’s potential utilizing numerous methods and assets that enable you to penetrate it with as little as zero money invested. This approach is rather unconventional and employs creativity, perseverance, and readiness to grow and evolve.

Real Estate Partnerships

Entering into RE partnerships is another way through which one can begin the practice of real estate investment with no cash. Being able to manage someone else’s money therefore means that you can team up with a person with cash, but no time, or knowledge. It is necessary to stress that there are clear agreements and trust in such relationships.

Generally, you are the one responsible for the management of the property or the sourcing of the deals, but your partner handles the money part. Such an arrangement is beneficial for both parties to the investment thereby creating a win-win situation.

Seller Financing

Other forms of financing as mentioned include the ability to purchase real estate without having to engage in the normal banker’s financing. In this case, the role of the credit company is replaced by a seller – they offer you to purchase goods and make the necessary payments directly to them.

It is beneficial in a situation where the seller is active and ready to close a better deal on the contract. It shall be clear on who is protected and who is not under any circumstance there is disagreement. Seller financing is a real option only if the latter allows you to control the property with a minimum amount of capital at the initial stage.

Lease Options

The Lease option, also known as rent-to-own, is another way of investing in real estate with little cash. In concurring to Novation, this strategy encompasses the use of lease option, where one takes a property for a designated period of time with the likelihood of acquiring the property permanently after a specified amount of time.

The major component that you need to make is usually to be attached to the future purchase price of the house you are renting. This provides you with adequate time to save for the down payment while at the same time enjoying possible appreciation on the property. It is quite useful when it comes to entering the market steadily and creating equity in the long run.

Hard Money Loans

Private financing solutions associated with real estate are hard money loans and it is a short term and interest based finance. Such loans can be accessed with a faster ease than you would have to when accessing normal bank loans hence making its options for quick credit requirements.

But they attract higher interest rates and fee charges and, therefore, should be used with a clear strategy of how to clear the loan within the shortest time possible. Private money loans are particularly popular among flipping, or as a short-term bridge loan.

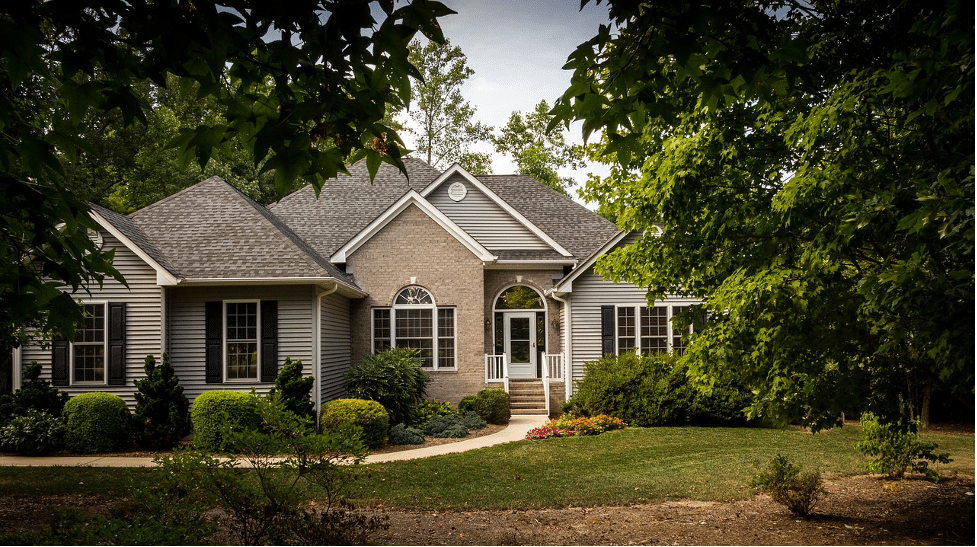

House Hacking

House hacking is the act of purchasing a property containing multiple units and residing in one unit while leasing out the other units (https://www.cnbc.com/how-house-hacking-is-helping-gen-z). The revenue pulled from the other units can supplement your monetary obligation of mortgage hence living in the house without paying much or even living for free.

It allows you to cultivate and construct the equity that will bring in an income for you. It is a wise method to enter the stock market with little capital and cut on some of the costs of living. It is for this reason I consider house hacking as a great entry point into the real estate investment business.

Private Money Lenders

A private money lender can therefore be described as an individual who is willing and able to lend his or her own money to real estate investors. One of the first things you’ll learn real estate investing is that a lot of people are interested. They can be relatives, friends, or business partners and are usually more lenient with their conditions as compared to other financial institutions.

Entering into a private money loan, it is essential that the borrower develops levels of trust and set up a good rapport with the private money lenders. Compared to banks they provide funding with no necessity to go through weeks of approval like in the case of banks. This is because good relations are key in any given partnership and hence ensuring that one has a proper plan on how to make repayments is very vital.

Government Programs & Beyond

There are many state and federal initiatives aimed at the support of investors with the provision of grants, available at low interest rate or in the form of tax credits. For instance, the Federal Housing Administration (FHA) developers lose credit for housing investing whereby they offer credit loans with a minimal down payment, thus giving the inexperienced credit developers an easy beginning chance.

Real estate investments can also, popularly, be funded using credit cards, or personal loans, which are somewhat dangerous but efficient if well worked out. This strategy covers the use of money borrowed to pay for the initial deposits or the improvements of the property.

Equally important is the repayment plan to ensure that charges for interest are not enormous, and the customers and the business are not pressed. Borrowing of credit and proper management of finances is crucial so that it does not lead to financial problems. With this method, you can grab chances when presented to you or when they appear.