Barcodes are extremely widespread in Asia – in Pakistan, for example, they are used to remunerate by a network of 1.2 million merchants. Similarly, India and China, some of the world’s biggest economies, see unprecedented scale when it comes to barcode transactions.

In India, they reached 346 million in 2024, while in China QR scanning is the most popular method for 95.7% of mobile users. Almost every everyday digital reimbursement in urban China runs through a QR flow in Alipay, WeChat Pay, or electronic Chinese yuan (e-CNY). Overall, the east Asian region is estimated to boast $2.37bn of barcode transactions.

Meanwhile, in Europe and the UK, barcodes are yet to fully put the pedal to the metal. Yet there are promising developments – some researchers believe that European adoption will accelerate by over 15% every year on average, rising from $2.72bn (impressive amount, but still behind the Asian countries) to $8.71bn by 2032.

As the main drivers, analysts cite EPC and central banks aligning the SEPA-level processes for interoperability, and the emergence of neo-bank groundbreaking platforms.

Noda: story of an innovative platform

Let’s take a look at one of such platforms. Noda is a fintech company in the UK and Europe, which offers barcode transactions as part of its product stack. Founded in 2018 with initial support from entrepreneur Dmitry Volkov, the company later underwent a change in ownership. Volkov exited the business in 2023, ceasing the Noda-Volkov affiliation.

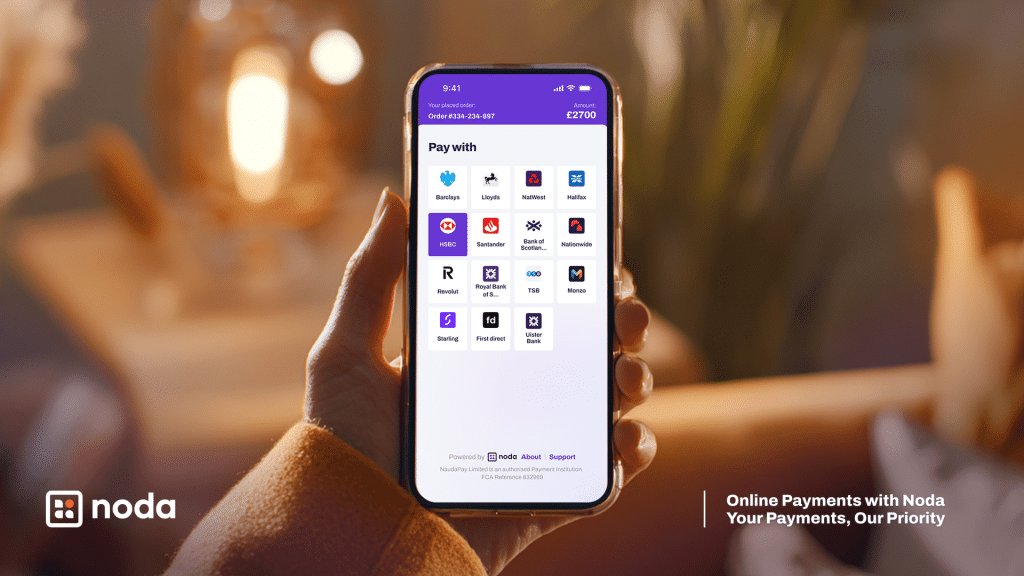

Noda’s core offering is open banking payments, a solution already adopted by more than 16 million users across the UK. One way this technology can be brought into physical retail is through QR code–based payments. For merchants, this approach offers minimal technical barriers, rapid deployment, reduced processing costs, and a smoother user experience than traditional card payments.

The users experience it as simple and straightforward: they scan, choose their financial institutions and authorise the transfer of funds through their banking app. This initiates the account-to-account movement of money, with no card networks involved in the process.

Noda payment reviews signal user satisfaction

The QR solution for offline retail sales was launched in 2025, and Noda already boasts some positive reviews from merchants.

Merchant feedback points to strong usability in real retail settings. Donna Brown, who owns the Scotland-based Barber Brown, noted that customers respond well to the speed and simplicity of the experience, highlighting that setup requires only a phone and access to Noda’s dashboard to create a QR code.

A similar sentiment appears in a Noda payment review from a Brazilian deli in London. Owner Kelly Ferreira said she was surprised by how quickly shoppers adopted the new payment option, adding that customers found it intuitive and easy to understand from the very first week.

The key insights from Noda payment reviews show that, firstly, merchants appreciate smooth integration; secondly, customers find the interface intuitive, which are both promising points for the development of QR infrastructure in the UK and Europe.

QR codes enable more options for customers

Yet the allure of barcodes lies beyond simply just their practicality on the ground. In fact, their versatility is what matters most. Barcodes open up doors for a wide range of methods that previously weren’t available in-store, for example, open banking.

Commonly referenced as direct payments, it allows customers to pay from account, money landing directly in the merchant’s deposit. They are more efficient on multiple layers: cheaper for merchants, easier for customers. They remove friction, and increase financial transparency. Countries around the world embrace this new technology.

Yet how you enable such transactions offline remained a hurdle. Pay-by-bank relies solely on the bank interface, which is inherently digital. QR codes fix that problem. Because customers use their mobile phones to pay, they can easily use their applications.

However, this is only the testing ground. Barcodes can bring more opportunities for cryptocurrency as well. At the end of the day, this is about giving your customers choice.

Future of QR payments in Europe

As we enter 2026, the global market for barcode transactions will keep growing – from $12.56bn estimated in 2024, to $61.74bn in 2033, as forecast by GrandView Research.

Admittedly, Europe is lagging behind barcode behemoths such as China, yet tides are shifting. Research shows that customers are ready for the innovation, especially digitally-native GenZs. There are also cutting-edge providers, such as Noda, experimenting in the field.

The ball is with businesses – as they get more knowledgeable about what QR codes can offer, adoption will steadily increase.