Starting your investment journey may seem confusing especially when you are still studying or starting your first job. But what if investing did not need a huge amount or deep market knowledge. Systematic Investment Plans (SIPs) make it easy. With just ₹100 a month, you can begin investing in mutual funds and start building wealth over time. SIPs offer an affordable and disciplined way to grow your money, one small step at a time.

What is a Systematic Investment Plan (SIP)

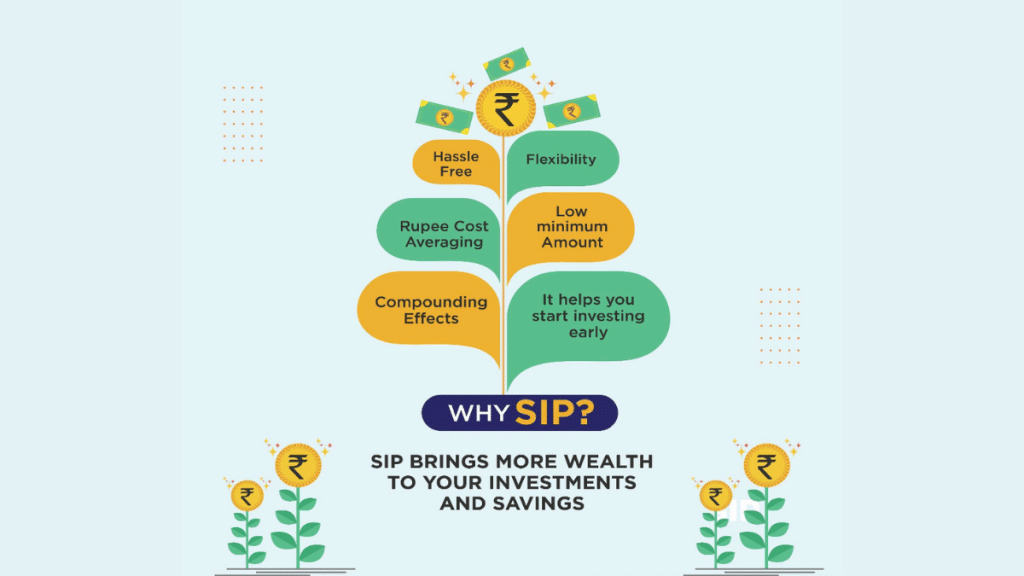

A Systematic Investment Plan allows you to invest a fixed amount regularly typically monthly into a mutual fund scheme. It helps spread your investments over time and brings discipline to your savings habit. Over time, SIPs may help build wealth through compounding and cost averaging.

Why SIPs Work Well for Gen Z

- Affordable: Start with just ₹100 suitable for students and young earners.

- Convenient: Automatically debited from your bank account.

- Compounding Effect: Returns earned are reinvested, helping your money grow.

- Rupee Cost Averaging: You buy more units when prices are low, and fewer when they’re high averaging your cost over time

- Quick Online Setup: Just complete KYC and begin.

Minimum Investment Start Small, Think Big

You do not need to wait for a high salary to start investing. Many mutual funds offer SIPs starting at ₹100 per month. As your income grows, you can opt for a Top Up SIP, which automatically increases your investment over time.

Choose the Right Fund Based on Risk Appetite

Every investor has a different comfort level with risk. Here is a simple guide to choose funds:

- Low Risk: Debt or liquid funds – good for short term, stable returns.

- Medium Risk: Hybrid funds – a balanced mix of equity and debt.

- High Risk: Equity mutual funds – suitable for long term wealth creation goals.

How Rupee Cost Averaging Benefits You Over Time

By investing regularly, you avoid the need to time the market.

- 5 Years: Helps manage market ups and downs.

- 10 Years: Compounding begins to show real growth.

- 20 Years: Even a small SIP can grow into a large corpus due to disciplined investing though returns are market linked and not guaranteed.

Can SIPs Help Beat Inflation and Fund Your Dreams?

SIPs in equity mutual funds have the potential to generate returns that may outpace inflation in the long run. You can align your SIP to personal goals like:

- Travelling abroad

- Higher education

- Skill development

By staying invested regularly, you build a habit and a corpus to support these goals over time.

Understand the Risks Before You Begin

While SIPs make investing simple, it is important to be aware of the risks:

- Market Risk: Returns are not fixed and depend on market performance.

- No Guarantee: Mutual funds are subject to market risks.

- Long Term Focus Needed: Stopping early may reduce the potential benefits.

- Fund Choice Matters: A mismatch with your risk level or goal can affect your experience.

How to Start a SIP Online

- KYC Compliance: Use PAN, Aadhaar, and video verification.

- Choose a Fund: Based on your financial goal and risk appetite.

- Enter SIP Details: Decide amount, frequency, and start date.

- Bank Mandate: Authorise auto debit from your bank account.

- Confirm & Invest: Review the details and start your SIP.

Other Important Considerations

- Liquidity: Some funds have lock ins or exit loads check before investing.

- Volatility: SIPs help manage it, but returns may vary in the short term.

- Time Horizon: The longer you stay invested, the better the potential outcome.

Conclusion

SIPs are one of the easiest and most beginner friendly ways for Gen Z to begin investing. With low entry amounts, flexibility, and the potential to build wealth gradually, they help young investors start early and stay consistent. Whether your goal is to study further, travel the world, or just build a safety net, SIPs can be a smart and simple companion on your financial journey.

FAQs

Q1. What’s the minimum amount to start a SIP?

You can start with just ₹100 per month in many mutual fund schemes.

Q2. Are SIP returns guaranteed?

No. SIP returns are market linked and may vary. However, long term investing helps reduce risk and improve potential returns.

Q3. Can I increase my SIP later?

Yes. With the Top Up SIP option, you can increase your investment amount automatically at regular intervals.

Q4. Which fund is best for new investors?

The choice of mutual fund depends on an investor’s risk appetite, financial goals, and investment horizon. New investors can explore different types of funds such as equity, debt, or hybrid based on their comfort with market fluctuations and return expectations. It is important to understand the fund’s objective and consult a financial advisor before investing.

Q5. How long should I continue my SIP?

SIPs are most effective when held for the long term preferably 5 years or more for compounding to work.