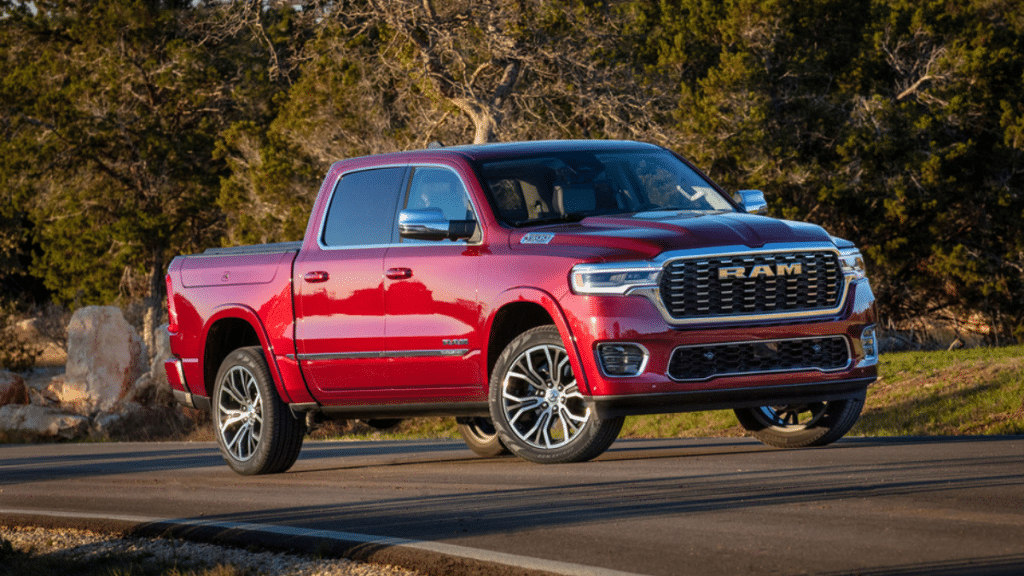

If you’re shopping for a New Ram 1500 for sale, one of the most important decisions you’ll face is whether to lease or buy the truck. The Ram 1500 is known for its balance of performance, comfort, and utility—making it a popular choice for both work and daily driving. But once you’ve picked out your trim, color, and engine, you’ll need to decide how you’re going to pay for it. Leasing and buying each have distinct advantages and drawbacks, and the right option depends on your financial situation, driving habits, and long-term goals. This guide will walk you through both options to help you determine which is best for your needs.

What It Means to Lease a Ram 1500

Leasing is a method of driving a new vehicle without taking full ownership. Essentially, you’re paying for the truck’s depreciation over a fixed term—usually two to four years. When the lease ends, you return the vehicle or have the option to buy it. Lease contracts typically come with mileage limits and guidelines about wear and tear. If you like driving a new vehicle every few years and want lower monthly payments, leasing might appeal to you.

What It Means to Buy a Ram 1500

Buying means financing or paying cash to eventually own the vehicle outright. Unlike leasing, there are no mileage caps or end-of-contract returns. You can modify the truck as you wish, drive it as much as you like, and sell or trade it at any time. Buying is ideal for drivers who want to build equity in their vehicle and avoid monthly payments in the long run.

Upfront Costs: Lease vs. Buy

When you lease a Ram 1500, the upfront costs usually include the first month’s payment, a security deposit, acquisition fee, and possibly a down payment. These initial costs are generally lower than what you’d pay to buy.

Buying a truck usually involves a larger down payment, especially if you want to secure a lower interest rate or reduce your monthly loan payments. In both cases, the total amount upfront varies depending on your credit score and the dealership’s terms.

Monthly Payment Comparison

One of the biggest advantages of leasing is the lower monthly payment. Since you’re only covering the cost of depreciation during the lease term, payments can be hundreds of dollars less than loan payments.

However, while loan payments are higher, they eventually end—leaving you with a vehicle you own. Lease payments never stop if you continue to lease new vehicles, so in the long run, buying can be more cost-effective.

Mileage Limits and Driving Habits

Leases come with strict mileage limits—usually between 10,000 and 15,000 miles per year. If you exceed those limits, you’ll pay a per-mile fee at lease-end. This can become expensive if you drive a lot for work, travel, or recreation.

Buying is better for high-mileage drivers because there are no restrictions. If you plan on using your Ram 1500 for long commutes, road trips, or towing, ownership is likely the smarter financial choice.

Maintenance and Repair Responsibilities

Most lease terms fall within the truck’s factory warranty period, which means major repairs are often covered. Some leases also include routine maintenance, reducing your out-of-pocket costs.

When you buy, maintenance and repair responsibilities fall on you once the warranty expires. However, owning the vehicle gives you more freedom to choose where to service your truck, and you can potentially save money with independent mechanics.

Customization and Personal Use

A leased vehicle must be returned in near-original condition. Any modifications—like lift kits, custom lighting, or bed accessories—will need to be removed, or you may face additional fees.

If customizing your Ram 1500 is important to you, buying is the only real option. Ownership gives you complete control to personalize your truck to match your work needs, hobbies, or style.

Resale Value and Trade-In

Leased vehicles are returned to the dealership, and you walk away with no ownership or equity. You don’t have to worry about resale value, but you also don’t benefit from it.

When you buy, you can trade in or sell the truck later, potentially recouping some of your investment. The Ram 1500 generally holds its value well, especially if it’s well-maintained. This resale potential can be a strong financial advantage in favor of buying.

Long-Term Cost Considerations

Leasing often seems more affordable in the short term, but over the long haul, it can be more expensive. When you lease, you’re constantly making payments without gaining ownership. Over 10 years, three consecutive leases could cost more than simply buying and owning a truck.

Buying may be more expensive up front and monthly, but once your loan is paid off, you own the vehicle and can drive it payment-free for years. This long-term savings is often overlooked but critical when evaluating total cost.

Insurance and Tax Differences

Lease agreements typically require higher insurance coverage, including GAP insurance, which covers the difference between the vehicle’s value and the remaining lease balance if the truck is totaled.

When you buy, insurance requirements may be more flexible. Also, sales tax on leases is often spread out across your monthly payments, while buyers may need to pay the full tax amount up front.

Lifestyle and Financial Flexibility

Leasing provides more flexibility for drivers who like upgrading vehicles frequently. You get the latest technology, safety features, and fuel efficiency every few years without the hassle of selling or trading in a vehicle.

Buying provides more freedom and long-term financial stability. Once you own your Ram 1500, you can decide whether to keep it, sell it, or pass it down. There’s no contract binding you to a return date or mileage cap.

End-of-Term Options

When your lease ends, you can return the truck, lease a new one, or buy the vehicle at a predetermined residual value. This flexibility is helpful if you’re unsure how long you want to keep a vehicle.

When you buy, there is no end-of-term decision—you simply continue driving your vehicle as long as you like, with no additional payments once the loan is paid.

When Leasing Makes More Sense

Leasing might be the better choice if:

- You want lower monthly payments

- You drive fewer than 12,000 miles per year

- You enjoy having a new vehicle every few years

- You want predictable maintenance and warranty coverage

- You don’t plan on customizing your truck

If these describe your situation, a lease could provide convenience and savings in the short term.

When Buying Is the Better Option

Buying is often the right decision if:

- You plan to keep your truck for more than five years

- You drive long distances regularly

- You want to customize your Ram 1500

- You’re interested in building equity in your vehicle

- You want to avoid perpetual payments

In these cases, ownership delivers greater long-term value and freedom.

Conclusion

Deciding between leasing and buying comes down to your priorities. If you want lower monthly payments and the freedom to switch vehicles every few years, leasing can be appealing. However, if you’re focused on long-term savings, high mileage use, or customizing your truck, buying is the smarter path. Both options offer unique benefits, and the best choice depends on your lifestyle, financial goals, and how you plan to use your truck. By carefully comparing the pros and cons, you can choose the path that maximizes value and satisfaction from your Ram 1500 investment.