Why Good Quotes Still Lead to Bad Surprises

You finally got what looked like a solid freight quote—fixed price, clear timeline, door-to-door. So why did your total landed cost end up 30% higher than expected?

Welcome to the reality of shipping from China to US in 2025. Even an “all-inclusive” quote can hide extra charges, poorly defined terms, or logistical gaps that quickly erode your margin.

Whether you’re a first-time importer or a seasoned Amazon FBA seller, cost overruns rarely come from the base rate. They come from traps—nine of them, to be exact—that can quietly inflate your shipping budget.

Let’s unpack them.

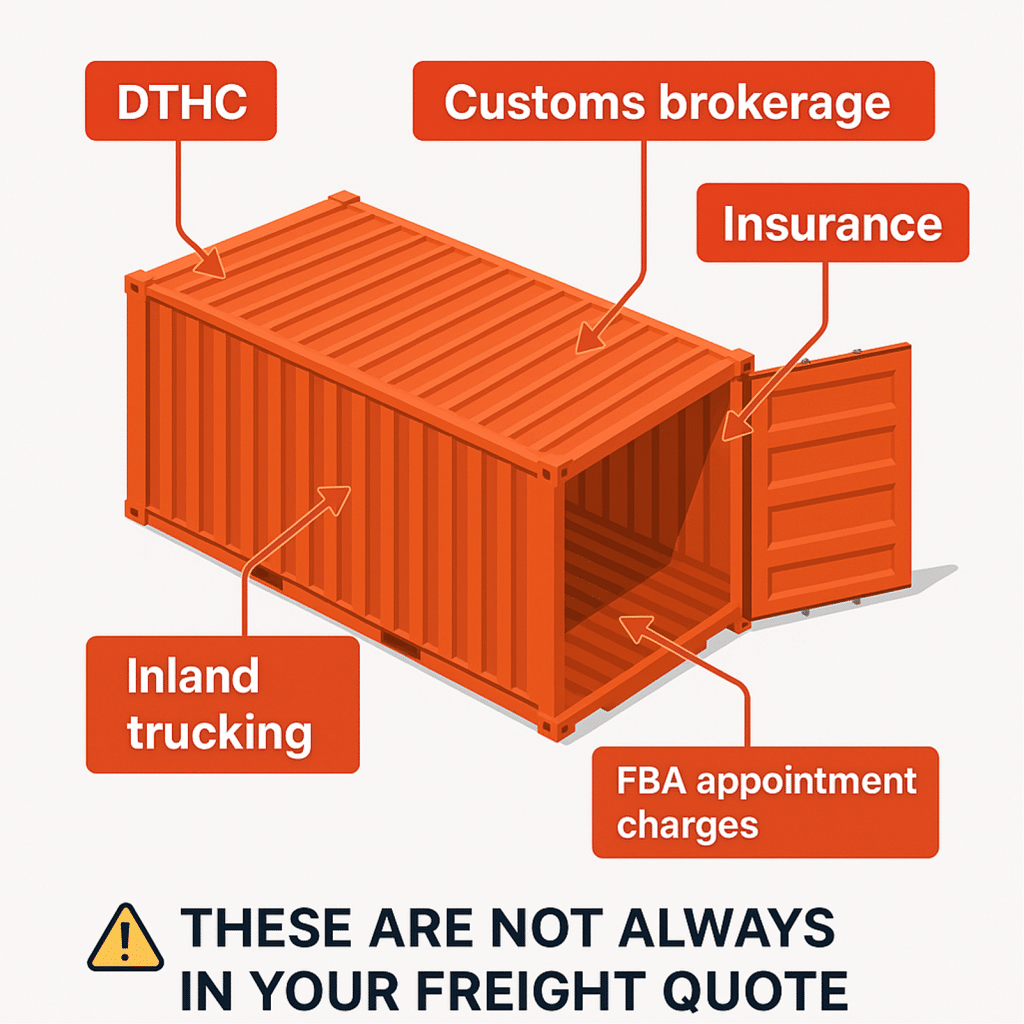

Trap #1: Hidden Gaps in “All-In” Freight Quotes

At first glance, comparing two freight quotes seems easy. But not all quotes include the same services. One forwarder might quote port-to-port; another includes door delivery and customs clearance. The difference? Hundreds of dollars and hours of coordination.

Common exclusions:

• DTHC (Destination Terminal Handling Charges)

• Final-mile trucking or FBA delivery

• Customs clearance, insurance, or paperwork fees

Pro Tip: Ask for a fully itemized quote with Incoterms, delivery assumptions, and what is or isn’t included.

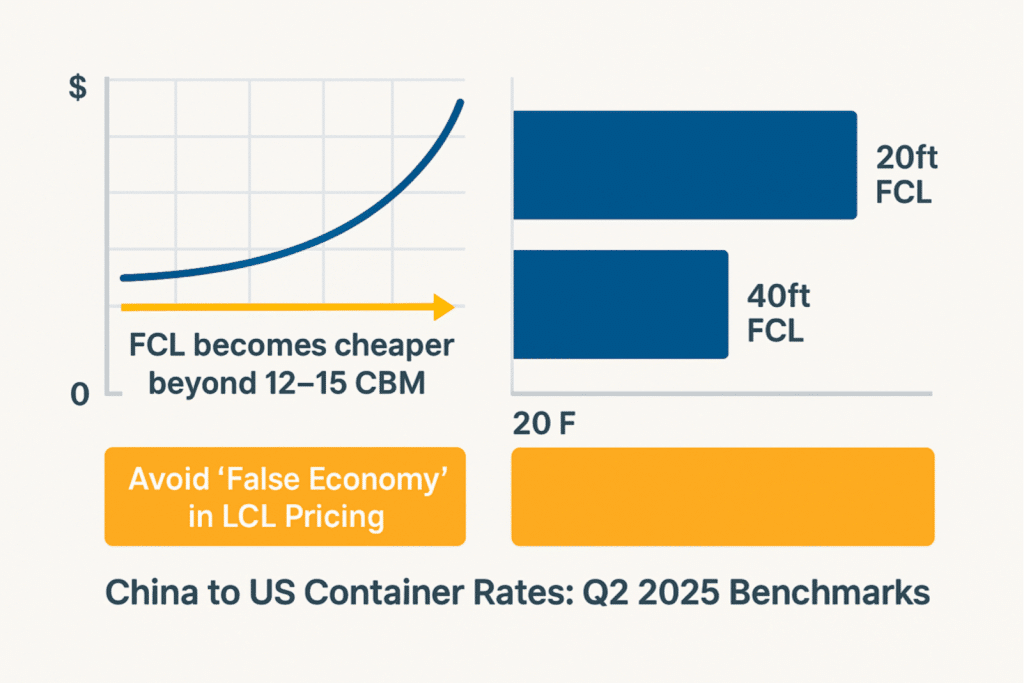

Trap #2: Misreading the Math on China to US Container Rates

Less-than-container-load (LCL) shipping seems ideal for smaller shipments. But once your volume hits 12–15 CBM, full-container-load (FCL) often becomes more economical.

A typical 13 CBM LCL shipment might include:

• $1,170 base freight (13 × $90)

• $320 in handling/docs

• $240 in trucking

• Total: $1,730

Meanwhile, a 20ft FCL might cost $1,800—with fewer delays, lower per-unit cost, and simpler logistics.

Strategy: If you’re close to the threshold, consider consolidating orders to unlock FCL benefits. Use updated China to US container rates as a benchmark.

Trap #3: Mismanaging Amazon FBA Deliveries

Amazon has strict delivery standards. If your freight provider doesn’t coordinate the delivery window, label specs, or tail-lift truck, you’re on the hook for delays and penalties.

What can go wrong:

• Missed appointments: $100+ reschedule fee

• Tail-lift or pallet jack charges

• Dock refusals from incorrect paperwork

Real Example: A shipment delayed 3 days due to missing box labels resulted in a $400 loss in rush fees and missed sales.

Tip: Use a freight partner who understands Amazon’s playbook—or risk getting penalized.

Trap #4: Underestimating 3PL Final-Mile Costs

Port arrival doesn’t mean delivery. Local trucking, warehouse scheduling, unloading fees, and fuel surcharges can add $200–$600+ per shipment.

Common missed costs:

• Chassis fees or congestion surcharges

• Curbside-only delivery without unloading

• Missed slot fines or wait time charges

Solution: Request a door-to-door or DDP quote that includes final-mile delivery—especially if your warehouse isn’t near a major port.

Trap #5: Overlooking Documentation & Compliance Risks

Small errors in HS codes, packing lists, or invoice values can trigger:

• Customs reprocessing: $100–$300

• Storage fees: $75–$150/day

• Product relabeling or reclassification

High-risk importers include:

• First-timers using FOB/CIF without guidance

• Amazon sellers with multiple suppliers

• Regulated products (batteries, electronics, food-contact items)

Best Practice: Have your freight forwarder perform a pre-shipment document review.

Trap #6: Choosing the Cheapest Quote Without Breakdown

A low quote might omit key fees like customs, insurance, or delivery. Without clarity, “cheap” often becomes expensive.

Red flags:

• Vague fees like “handling” or “misc. services”

• No mention of DTHC or final delivery

• Too-good-to-be-true DDP promises without details

Compare quotes apples-to-apples, and ask for total landed cost—including all legs of the journey.

Trap #7: Forgetting Peak Season Price Volatility

Even if you secure a reliable freight partner and understand your Incoterms, failing to account for seasonal price shifts can still wreck your shipping budget.

Ocean freight from China to the U.S. follows a predictable—but steep—rate curve tied to global demand surges, including:

• Pre–Chinese New Year rush (Dec–Jan)

• Back-to-school and Q3 e-commerce buildup (July–Sept)

• Holiday peak season (Oct–Nov)

Rates during these windows can spike by 30–50%, and container availability often tightens weeks in advance—especially for FCL shipments and Amazon FBA destinations.

Real-world example: A brand that normally paid $1,800 per 20ft FCL saw rates rise to $2,700 in late January due to the Lunar New Year backlog—and faced port congestion that delayed their launch by 10 days.

Avoid the trap:

• Book at least 3–4 weeks ahead of peak seasons

• Build a rolling inventory buffer for your top SKUs

• Use your forwarder’s rate forecast to lock in pricing or explore off-peak routes

Freight cost planning isn’t just about quote shopping—it’s about shipment timing. And importers who ship smart, not just cheap, are the ones who preserve their margins year-round.

Trap #8: Treating Cargo Insurance as Optional

With thousands of dollars in goods crossing oceans, it’s shocking how many importers skip insurance—assuming lost or damaged cargo is rare or that carriers will cover it. Both assumptions are dangerously wrong.

Here’s what many don’t realize:

• Ocean carriers operate under limited liability, often capped at ~$500 per container.

• If your $15,000 worth of electronics is lost, stolen, or water-damaged? You might only recover a small fraction of the value.

• Common risks include:

• Container accidents during loading/unloading

• Water ingress or mold during long transits

• Pilferage in transshipment hubs

• Delays leading to expired product shelf life

Real loss: A small beauty brand lost $7,800 worth of goods in a flooded container en route to LA. Without insurance, they absorbed the entire hit.

Smart move: Always ask your forwarder for cargo insurance options. Most policies cost 0.3–0.5% of declared value—an affordable safeguard compared to the cost of replacement inventory or lost sales.

Pro tip: Confirm what the insurance covers—some exclude batteries, electronics, or high-value items unless declared specifically.

Don’t let a single damaged container wipe out your quarterly margin. In 2025, insurance isn’t optional—it’s essential risk management.

Trap #9: Not Communicating Clearly With Your Freight Partner

No matter how optimized your quote or well-planned your route, a lack of clarity between importer and freight partner can still break your budget.

Here’s how miscommunication leads to cost traps:

• Incorrect assumptions about delivery ZIP codes or warehouse appointment rules

• Overlooked DG declarations or packing specs that trigger repacking fees

• Missed transit time commitments due to unclear lead times or cut-off dates

Example: An importer assumed 14-day transit from Ningbo to Houston but missed the cut-off by one day due to a public holiday, adding a full week of warehouse delay and $500 in extra storage.

Prevention tip: Choose freight partners who provide not just pricing—but context.

Ask for explanations when you don’t understand line items. Push for clear timelines with buffer windows. Align responsibilities up front (e.g. who books customs bond, who schedules FBA appointments).

Working with teams like GORTO means fewer “assumptions,” and more clarity—before you sign off on your next shipment.

Final Thoughts: Avoid the Iceberg Beneath the Rate

The biggest shipping cost isn’t always what’s printed on the quote—it’s the missing details. By clarifying services, watching volume thresholds, and prioritizing total landed cost, importers can avoid nasty surprises.

So before you approve your next freight quote, pause and ask:

“Is this the real price—or just the surface?”