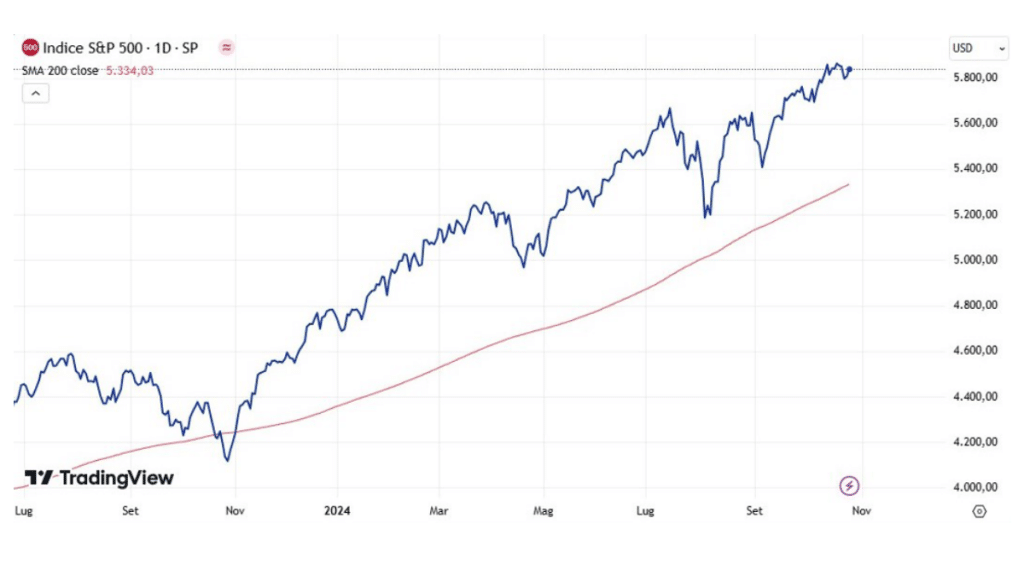

2024 is set to close with another historic milestone for the S&P 500, with annual returns currently around 23%. Early forecasts predicted a flat market, but these projections have been repeatedly revised upwards throughout the year as the market consistently outperformed, delivering even greater returns.

Despite geopolitical shocks from the Russian-Ukrainian conflict, turmoil in the Middle East, the U.S. presidential election, and declining interest rates, a robust labor market and inflation dropping below the most optimistic forecasts have fueled this impressive rally, which may still have room to grow. David Kostin, Chief U.S. Equity Strategist at Goldman Sachs Group Inc., expects that the index could reach an all-time high of 6,000 points by year’s end, with a 12-month target of 6,300 points. Kostin also recently released a report cautioning that, following such record gains, the market could enter a prolonged period of stagnation or decline, potentially lasting a decade, with nominal gains of just 3% (1% adjusted for inflation). While this might appear overly cautious in today’s bullish environment, history suggests caution is wise. Let’s dive into this further.

A “lost decade” refers to a period when a 60/40 portfolio investor would have experienced negligible or negative real returns after inflation. This isn’t as rare as one might think; six such periods have been recorded, typically when either equity or bond markets were highly overvalued.

In his weekly report, Jesse Felder illustrates that the S&P 500 currently holds the highest P/E ratio in 60 years ahead of expected Fed easing. The more overvalued a stock at purchase, the lower its return in the following decade. Currently, the entire U.S. stock market is valued above pre-Great Depression levels and close to the dot-com bubble’s peak.

This analysis is critical for the long term. In the short term, the market may experience “irrational exuberance,” pushing valuations even higher. Yet, over the long term, valuations are a powerful indicator, and analysts like David Kostin predict a more bearish outlook for the coming decade.

One closely watched measure for assessing long-term stock value is the CAPE (Cyclically Adjusted Price/Earnings) ratio, developed by Benjamin Graham in the 1930s and popularized by Nobel laureate Robert Shiller in his bestseller Irrational Exuberance. The CAPE compares current prices with inflation-adjusted average earnings over the past decade. After hitting a peak during the pandemic, when governments injected record liquidity, the CAPE recently reached new highs since the release of ChatGPT. It appears that a mix of liquidity influx and the AI boom is now helping drive the market.

When analyzing stocks alongside bonds, Shiller’s “Excess CAPE Yield” metric, which subtracts the 10-year Treasury yield from the CAPE Yield, becomes relevant. This measure, widely used by top analysts, has only turned negative twice: during the Great Depression and the dot-com bubble.

In any long-term analysis of the U.S. market, both equity and bond factors are essential. Exiting the market now could mean missing out on profits during a period of high exuberance, but staying mindful of the overall picture is crucial. Currently, we’re seeing historic highs, with tech giants lifting the rest of the market. The question is whether, and for how long, riding this wave will be advantageous — because, as history shows, downturns after such highs can be steep.