US and European stock futures are trading near the flat line with sellers in control of the price momentum. There have been several factors behind the current price action which have influenced the sentiment among investors, however, the main factors have been in the realm of political developments, economic data, and corporate earnings.

Friday’s Market Performance

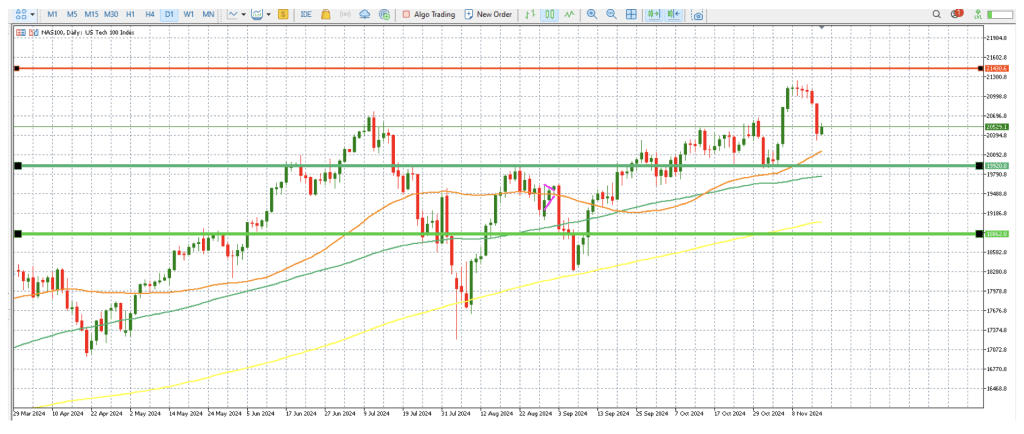

The US stock market had one of its worst decline since Election Day on Friday, November 15, 2024. The Nasdaq Composite experienced a 2.2% decline, the S&P 500 experienced a 1.3% decline, and the Dow Jones Industrial Average shed 0.7%. The decline was spearheaded by technology stocks, as investors and traders reevaluated their positions in response to the heightened regulatory concerns and skyrocketing bond yields.

US 100 Chart by XTB

The 10-year Treasury yield increased to approximately 4.45% in the bond market, as U.S. Treasury yields increased. This action is indicative of the persistent apprehension regarding inflation and the speculative nature of harsher monetary policies. High-growth sectors, particularly technology, have been particularly affected by these developments, as they are more susceptible to fluctuations in borrowing costs

Fundamental that are driving markets

Retail Sales: Last week, we saw the US retail sales data revised for September, and the data boosted confidence to some extent as it implied that consumer spending remains resilient. Although this was a positive indicator, it also emphasised the Federal Reserve’s difficulty in managing inflation without impeding growth.

Empire State Manufacturing Index: Regional disparities were underscored by unexpected growth in this index, which demonstrated regions of strength in the manufacturing sector amidst broader economic uncertainty.

Inflation: The Consumer Price Index (CPI) for October was consistent with expectations. Nevertheless, persistent inflationary pressures continue to be a source of concern, which has an impact on the Federal Reserve’s policy outlook and the sentiment of investors.

Sector Trends and Corporate Earnings

Among the factors that is influencing the market sentiment, the corporate earnings continue to remain the main factor on the traders’ dashboard as the earnings seasons continue to draw significant attention with some serious firecrackers ready to explode this week

Technology Sell-Off: The technology sector’s stalwarts, such as Meta Platforms and Arista Networks, were the primary drivers of Friday’s declines. This sector’s underperformance was significantly influenced by valuation concerns and increasing yields.

Resilient Sectors: Conversely, defensive investments, such as utilities and real estate, experienced gains as investors sought refuge from the general market turmoil.

Nvidia’s earnings report is one of the most eagerly anticipated events of the week. Analysts anticipate that Nvidia will experience an 82% year-over-year sales increase, which will be primarily driven by the increasing demand for AI processors, particularly the recently introduced Blackwell AI chip. It is anticipated that the company’s net income will increase by 89% to $17.4 billion, establishing it as a leading indicator of the technology sector.

Market Influences of Political Developments

The market landscape has been further complicated by political changes:

Appointments of the Trump Administration: The recent cabinet nominations of President-elect Donald Trump, which include Elon Musk for a newly established department that is dedicated to government efficiency and Robert F. Kennedy Jr. for the Department of Health and Human Services, have elicited a variety of responses. These appointments have the potential to result in policy changes in sectors that depend on government contracts and healthcare.

Trade and Fiscal Policy: Market sentiment is still being influenced by expectations regarding the fiscal and trade policies of the incoming administration, which have the potential to present both opportunities and risks.

Weekly Prognosis

The markets will be on strain as we enter the week due to a variety of factors:

Corporate Earnings: Nvidia’s performance is expected to have a significant impact on the broader technology sector, and its results will be closely examined.

Economic Data: In order to assess the economy’s health, investors will monitor supplementary economic indicators, such as consumer confidence and housing data.

Federal Reserve Policy: The bond and equity markets will be significantly impacted by any comments or decisions made by the Federal Reserve, given the ongoing inflationary pressures.

Political Developments: The market will also monitor the Trump administration’s policy agenda, with a particular emphasis on areas such as healthcare, energy, and infrastructure, for additional information.

Our Point of View

The market continues to be at a critical juncture. This is a challenging yet opportune environment for investors, as a result of the muddled economic data, corporate earnings surprises, and political developments. Long-term investors may perceive pullbacks in high-growth tech equities as potential entry points, while defensive positioning in sectors such as utilities and real estate may provide some stability.

In such an environment, it is imperative to maintain a diversified portfolio and remain agile. Despite the fact that short-term volatility continues to dominate headlines, the emphasis should always be on long-term fundamentals.