Since blockchain technology has been so crucial in the development of Decentralised Finance (DeFi), it is at the main front stage in the fast-changing financial scene. This growing financial ecosystem has challenged existing financial institutions by offering decentralized alternatives that cut middlemen, reduce costs, and let people take full management of their financial assets.

In this article, we will examine how Blockchain in DeFi is changing the path of finance, look at the purpose of blockchain in DeFi, and review the numerous components that form this novel system.

What is DeFi in Blockchain?

Now, let us answer the question: what is defi in blockchain? Designed on blockchain networks, Decentralised Finance (DeFi) is a system of financial apps running free from reference to traditional financial institutions, such as banks or middlemen. DeFi employs smart contracts on Ethereum and other blockchain systems to automate and safeguard transactions, therefore enabling users to access a wide range of financial services, including lending, borrowing, trading, and investment, all without depending on centralized authority.

Blockchain in DeFi has changed our perspective of money by giving everyone with an internet connection an open, transparent, permissionless system accessible to them. Apart from democratizing financial services, this decentralized method generates a safe and effective system running around the clock, free from the constraints of conventional finance.

How Blockchain Technology Powers the DeFi Ecosystem

The DeFi ecosystem’s backbone is blockchain technology. By using cryptographic mechanisms to validate, secure, and document transactions across a distributed ledger, it helps to decentralize financial services. Blockchain in DeFi is revolutionizing the direction of digital finance here:

1. Smart Contracts

Smart contracts are self-executing agreements with terms and conditions written straight into code. Once set criteria are satisfied, they automatically carry out actions, therefore eliminating middlemen. The DeFi ecosystem uses smart contracts to automatically manage lending, borrowing, and trading, therefore providing a faster and more efficient replacement for traditional financial institutions.

On DeFi lending systems, smart contracts, for example, automatically manage loan distribution and repayment, therefore reducing the need for outside involvement and the risk of human error.

2. Decentralization and Transparency

DeFi runs on decentralized networks, unlike conventional financial systems. So, no one person owns the system. Every transaction is entered on a public ledger, so this decentralization improves security and openness since anybody may check and audit the system’s running conditions.

Blockchain technology guarantees tamper-proof DeFi apps, therefore lowering the possibility of manipulation or fraud. Users keep complete control over their assets and transactions; the openness of the system helps to build more confidence.

3. Accessibility and Inclusivity

DeFi and the future of finance have one of the most important benefits in that they allow underprivileged groups who might not have access to conventional banking systems financial services. Whether one wants to lend, borrow, trade, or invest, anyone with an internet connection can engage in the financial ecosystem using DeFi.

DeFi is a great tool for the future of digital banking because its accessibility encourages financial inclusion worldwide.

4. Lower Costs

DeFi drastically lowers transaction fees and running expenses by removing middlemen and automating tasks using smart contracts. For services, including wire transfers, loans, or investment goods, traditional banking systems frequently feature levels of fees. DeFi platforms, on the other hand, charge just a small portion of these fees, so financial services are more reasonably priced and quick.

5. Interoperability and Composability

DeFi apps are made to be composable, so several platforms and protocols can interact and combine. Users of this interoperability can easily migrate assets between several DeFi platforms. A user might, for example, deposit money into a loan system, get interest, and then use those same monies as collateral for another DeFi business.

This interlinked ecosystem promotes creativity and helps to create advanced financial products—hardly feasible in traditional finance—that would be created with ease elsewhere.

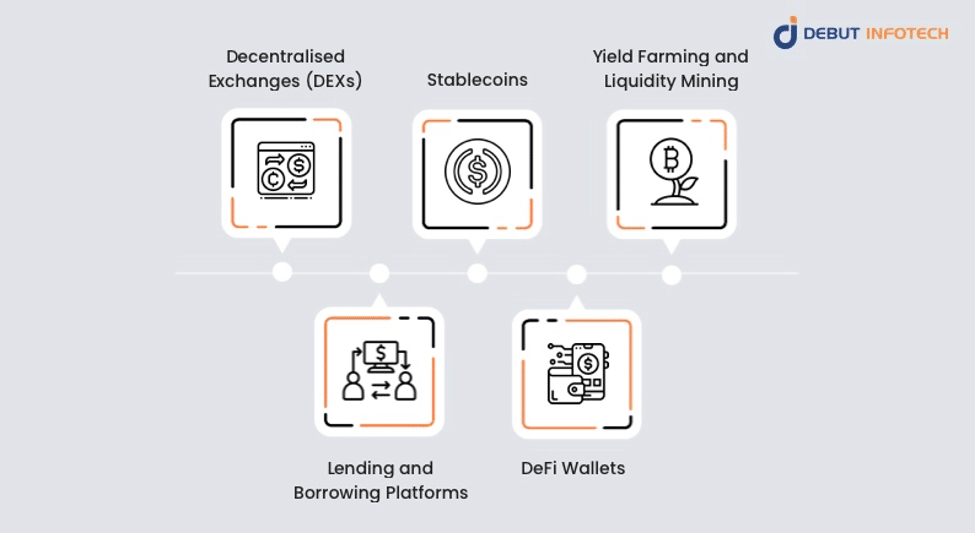

Key Components of the DeFi Ecosystem

The DeFi ecosystem is a decentralized replacement for traditional finance thanks in large part to many fundamental components. Among other things, these components consist of decentralized exchanges, lending and borrowing systems, stablecoins, DeFi wallets, and yield farming.

1. Decentralised Exchanges (DEXs)

Unlike centralized exchanges, decentralized exchanges (DEXs) let users trade cryptocurrencies straight with one another without an intermediary. Operating on blockchain platforms, DEXs automatically and safely carry out deals using smart contracts. Users trade peer-to-peer, therefore improving privacy and lowering the danger of hacking by keeping complete control over their assets.

2. Lending and Borrowing Platforms

While borrowers may get loans by offering collateral, DeFi lending systems let users lend their cryptocurrency holdings and get interest. These systems guarantee that the collateral stays safe until the loan is paid back using smart contracts, therefore facilitating lending. Compared to conventional loan methods, the procedure is quicker and more effective because it is fully automated.

3. Stablecoins

Some cryptocurrencies are called stablecoins and are connected to a stable asset, such as the US dollar, therefore reducing price volatility. Offering a constant store of value and medium of commerce, stablecoins are essential in the DeFi ecosystem. By enabling users to deal and trade inside DeFi systems, they protect consumers from the volatility of other cryptocurrencies.

4. DeFi Wallets

A DeFi wallet is a digital wallet designed to let users safely save and oversee their crypto assets. DeFi wallets are non-custodial. So, users have complete control over their private keys and assets, unlike with conventional bank accounts. These wallets let users exchange cryptocurrencies, engage with several DeFi systems, and directly handle their investments right from their devices.

5. Yield Farming and Liquidity Mining

Users of yield farming lend or bet their cryptocurrency holdings in return for benefits, usually more tokens. Liquidity mining gives decentralized exchange liquidity in return for rewards. These systems let users help the DeFi ecosystem to be liquid and functional while earning passive revenue.

DeFi and the Future of Finance

As blockchain technology evolves, the future of finance is becoming more decentralized. Unprecedented degrees of openness, efficiency, and inclusiveness seen on decentralized platforms challenge even established financial institutions in their ability to compete. Therefore DeFi and the future of finance are fundamentally interwoven.

DeFi protocols are projected to be increasingly used by institutional investors in the future of digital finance as well as new financial products and services developed on blockchain technology. DeFi is poised to revolutionize the whole financial sector with ideas including dedecentralizednsurance, prediction markets, and derivatives, thus improving accessibility, efficiency, and security for every stakeholder.

Challenges Facing DeFi

DeFi is not without difficulties, despite all of its benefits. The fast expansion of the ecosystem begs questions regarding security, scalability, and regulatory compliance.

1. Security Risks

Smart contracts can result in major financial losses if flaws and vulnerabilities find their way into them. Ensuring the security of protocols and platforms will be vital as the DeFi ecosystem grows, inspires confidence, and safeguards consumers’ assets.

2. Scalability Issues

Especially Ethereum, blockchain systems have struggled with scalability, which has slowed down transactions and increased fees in periods of strong demand. DeFi’s expansion will provide scalability issues that must be addressed if the ecosystem is to have long-term success.

3. Regulatory Uncertainty

DeFi runs in a mostly uncontrolled environment, which begs questions about how these platforms might follow future rules. Although DeFi’s decentralized character makes it challenging to apply conventional regulatory systems, as the ecosystem develops governments and regulatory authorities are probably going to adopt new rules.

How Debut Infotech Can Help with DeFi Development

Debut Infotech is a leading decentralized finance development company specializing in building advanced DeFi platforms using blockchain technology to deliver efficient, scalable, and secure solutions. Whether you need a custom blockchain app development solution or want to create a new DeFi platform, our expertise can help you navigate the complexities of decentralized finance.

1. Comprehensive DeFi Development Services: From conception and design to smart contract development and execution, Debut Infotech provides end-to-development services. Whether your company objectives call for a lending platform, a decentralized exchange, or a DeFi wallet, we know how to create a premium solution fit for them.

2. Blockchain Expertise: Having years of expertise in blockchain development, we are qualified to meet the technological difficulties of creating decentralized financial systems. Our staff keeps current with the most recent developments in blockchain technology so that your DeFi platform is built with the most secure and innovative solutions.

3. Regulatory Compliance: Being a reputable DeFi development company, we appreciate the need for regulatory compliance inside the DeFi ecosystem. Working with legal professionals, we make sure your platform follows the required rules and laws, assisting you to prevent possible legal obstacles.

4. Custom Solutions: At Debut Infotech, we value offering cucustomizedolutions that fit the specific needs of our customers. Whether your goal is to improve an already-existing DeFi platform or start a new one, we can design a solution fit for your vision and aims.

Conclusion

Unquestionably, decentralizations the direction the future of finance is headed, and blockchain in DeFi leads this change. Leveraging blockchain technology, the DeFi ecosystem is building a more inclusive, open, and effective financial system that questions the established wisdom.

Businesses and people both have to adjust to this new paradigm as DeFi develops by welcoming the advantages and chances that distributed finance presents. DeFi is changing our perspective on financial systems from better transparency and security to more accessibility and lefewerransaction fees.

Ultimately, the financial sector will continue to change as more companies and investors use this technology, creating new avenues for financial empowerment, inclusion, and innovation. Now is the moment to explore what DeFi can provide and collaborate with a reputable partner like Debut Infotech to help you create the decentralized solutions of the future, therefore keeping ahead of the curve.