How can miner management strategies be applied to real world challenges?

Cryptocurrency can seem like an inherently unpredictable field to navigate. However, the right mining hardware and techniques can help you make the most of your efforts, and reap the most rewards for the minimum amount of risk.

With this in mind, understanding the importance of an airtight miner management strategy is key to the long term success of your crypto mining. We’re going to take a closer look at how successful miner management strategies have been implemented in real-life challenges, and what factors are necessary in ensuring your success.

What is a miner management strategy?

Simply put, a miner management strategy is the way crypto mining efforts are managed in order to ensure minimum risks and costs, and maximum reward. Understanding the various strategies involved in crypto mining can help you utilise the techniques that are most suited to your set-up and ambitions, helping you get the most out of your cryptocurrency mining.

Real-world miner management strategies that cut costs

Certain strategies are designed to avoid periods of excess costs, reducing the amount you need to spend in order to get involved in the crypto mining industry. These include:

Peak Avoidance

One of the most useful strategies involved in cryptocurrency mining is Peak Avoidance. This is a response to unprofitability, as all miners come with a break-even point (when the cost of running outweighs the profits gained). A study was carried out to analyse the difference between miners which operated throughout a winter storm, and miners which powered down for periods in line with Peak Avoidance.

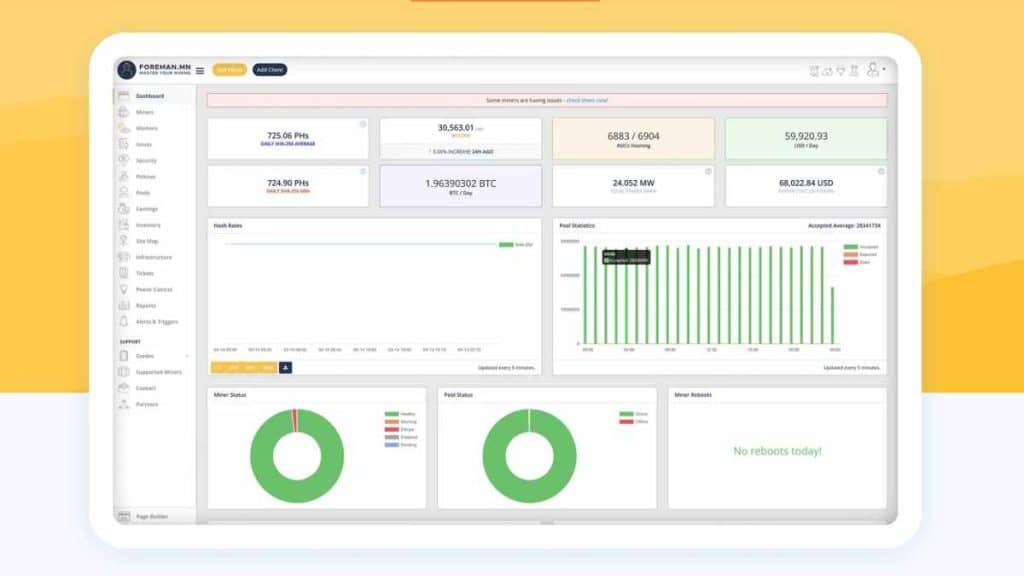

The study explored miners used by ERCOT. When working throughout the storm, miners lost a total of almost $80,000. Meanwhile, miners using a Peak Avoidance strategy implemented by Foreman mining management software managed to enjoy a profit of more than $90,000.

Selling Blocks

The same study was expanded to see whether greater profitability was possible through selling blocks. Not only were machines shut off when they passed the break-even point, but miners were paid for spinning down operations and sending the electricity back to the grid. This is what defines a Selling Blocks strategy.

Through Selling Blocks, an energy provider acts as a liaison between the energy producer and miner, securing a particular number of megawatts for a designated time frame – this is known as a block. By taking the same data from electricity prices over the winter storm in ERCOT, revenue from selling electricity blocks alone would come close to $120,000.

What makes a successful miner management strategy?

The things that make strategies like Peak Demand and Selling Blocks so successful is the way they aim to manage not only how much money you make, but how much you spend when mining. The best management strategies are risk management strategies: those that manage as many factors as possible, leaving very little to chance. Peak Demand greatly reduces your risk of losing money by shutting down operations if you aren’t turning a profit.

There is also plenty of general advice out there regarding cryptocurrency mining techniques. Of course, you should look to mine the most profitable token. Aim to mine coins that start at a low hash rate and acquire a lot of them – then see if they are added to an exchange. Mining the most profitable coin, selling it, and then buying other coins can help make the most of your investment. This is a form of speculative mining.

Mining profitability calculators are useful for determining whether or not you’ll turn a profit from a particular token. It’s also worth calculating your electricity costs, as mining will eat into those. By implementing the help of experts in the field like Foreman, you can enjoy the peace of mind that comes with effective long term management of your crypto miners, allowing you to focus on growing your investments.