U.S. equities have continued to build their April low rebound, though overall continues to exhibit sharp pressure. In spite of recovery since April 8th, closer inspection and analysis point toward continuing and persistent drawdown and fluctuation of performance among sectors and indexes. Here is the breakdown for the sectors and indices.

Industrials Take the Lead with Double-Digit Returns YTD

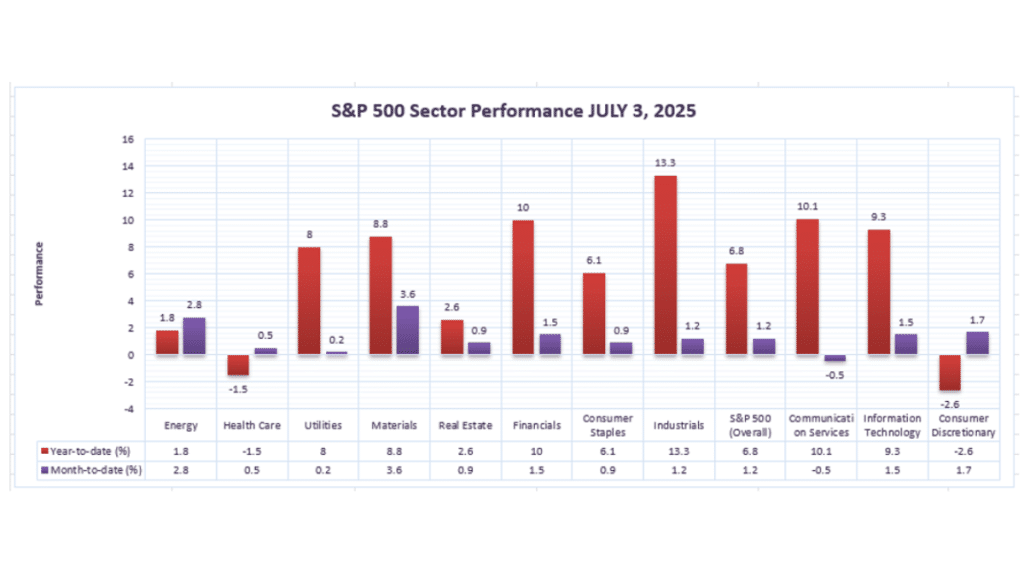

Though markets are recovering from first-half upheaval, S&P 500 sector leadership foretells a single resounding leader: Industrials. Ahead a healthy 13.3% on a YTD basis, Industrials have been the outperforming sector and a reflection of investor demand for shares tied to economic growth and infrastructure development.

Here’s a more in-depth examination of sector performance:

INDUSTRIALS: +13.3% YTD | +1.2% MTD

Industrials have been the strongest sector in 2025 to date, supported by growth in capital expenditure and supply chain normalization. Additional proof of its ongoing resilience is the sector’s +1.2% MTD increase as stable fund inflows reflect confidence in this sector to continue to be resilient. Industrials are supported by planned government expenditure on infrastructure and expansion across the manufacturing, logistics, and construction sectors.

Other main leaders are:

COMMUNICATION SERVICES: +10.1% YTD | -0.5% MTD

Whereas Communication Services saw a modest decline MTD, nevertheless, it is one of the best performers YTD. Strengths in media, digital communications, and streaming have continued to propel things forward, and growth in consumer demand for digital content has been a steady tailwind.

FINANCIALS: +10.0% YTD | +1.5% MTD

Financials have been aided by increased hope of increased rates and healthy bottom lines.Winners within sectors have been banks, life insurers, and other financials that will profit from increased rates, expanding profit margins throughout the sector.

IT: +9.3% YTD | +1.5% MTD

The Technology space remains a growth leader with resilient returns despite valuation ramifications. Spurred by innovation in AI, digital infrastructure, and innovation in cloud computing, technology shares remain resilient and indicative of growth ahead despite usual market swings. Conclusion Longer term, Industrials outperform and lead investor hopes of a cyclic recovery. When industries escape leadership, agreeing investors are behind growth on a longer term that is motivated by infrastructure investment and ongoing economic growth, then this robust showing by Industrials does bode well for a broader market climate in which cyclic units can take leadership on the next several months.

S&P 500: A broad-based rise continues, though weakness begins to show

S&P 500: Year-to-date spike of 7%; 26% recovery from April’s bottom; now 19% lower than year-to-date high; average member lower by 24%. You can learn more about what is indices trading here.

The S&P 500 is 26% above its April 8th bottom, and its year-to-date return is 7%. It is still 19% lower than its year-to-date high, though. And on average, its index member is 24% below its high, showing a narrow and not very diverse rally by a small group of leaders.

NASDAQ: LOUDEST RALLY, SADDEST FEELING RUNNIN’ UNDERGROUND

NASDAQ: +7% YTD | +35% on top of April low | -24% below YTD peak | Avg. member: -45%

The NASDAQ is showing leadership again, a 35% recovery from its April bottom accounting for a 7% advance thus far this year. It is still 24% lower than its high, and, on average, a NASDAQ stock has fallen 45%. This scenario explains why high-growth stock concerns have been lagging behind the broader market in a quest for a rally.

RUSSELL 2000: SMALL-CAP BLUES PERSIST FOLLOWING RALLY

Russell 2000: 1% YTD | 28% from April bottom | -24% vs YTD high | Av. member: -36%

The Russell 2000 advanced 1% on a year-to-date basis after a significant 28% comeback from a bottom hit in April, though still 24% below its high on the year. Meanwhile, small-capital shares on average have fallen 36%, showing a continued sense of unease within this small-capital market despite budgetary constraints and continued economic uncertainty.

DOW JONES: LEAST VOLATILE INDEX, BUT RISKY AS WELL.

The Dow Jones has been remarkably resilient, having increased by 5% so far this year and by 19% from its April lows. While the index is currently 16% lower than its high for the year, we have to recall that on average, a stock across the Dow has fallen by 23%. This reminder is important because it illustrates that defensive sectors have not been shielded from systemic ills that have hit the market in general.

While markets have largely gone back on their course after a bottoming out in April, days ahead are expected to pose tests as broad-based market weakness exists alongside a possible recovery strengthened by caution and resilience on a sectoral basis. Careful investors should exercise prudence and focus on investing resources on sectors and companies showing strength in face of prevailing economic uncertainty. Close tracking of changing market dynamics will dictate all moves as hidden risks can spoil the rally in its early stages.