Welcome to our comprehensive TheTrendsCentre.com review, where we dive deep into what makes this platform stand out in the world of online trading. Whether you’re a novice or an experienced trader, TheTrendsCentre.com has something valuable to offer.

Why Choose TheTrendsCentre.com?

In this TheTrendsCentre.com review, we highlight two critical factors for trading success: a user-friendly platform and extensive educational resources. TheTrendsCentre.com excels in both areas, making it a top choice for traders at all skill levels.

A user-friendly platform and access to educational resources are two crucial factors for success and both are prioritized in thetrendscentre.com platform. With a wealth of educational resources, the platform empowers traders with the knowledge they need to succeed.

These beneficial resources include video tutorials, webinars, articles, and comprehensive guide coverage on a wide range of topics, from the basics of trading to advanced market analysis techniques.

By providing access to this extensive library of educational materials, thetrendscentre platform ensures that traders of all skill levels can improve their understanding of the markets and refine their trading strategies.

A User-Friendly Platform

Through its intuitive and accessible trading platform, thetrendscentre.com feels proud to help novices and experienced traders in mind and offer a seamless trading experience. Traders can easily navigate through various trading options, analyze market trends, and execute trades with confidence.

Practical and Actionable Resources

Additionally, the platform aims to provide practical and actionable resources, helping traders to apply what they learn directly to their trading activities. The platform’s webinars often feature expert traders who share their insights and strategies, providing traders with valuable real-world perspectives.

This point of view underscores the need for practical learning that helps traders build their confidence and develop the skills they need to navigate the markets successfully.

Apart from educational resources, thetrendscentre.com offers a wide range of tools that cater to both newcomer and advanced traders, so that they have the best trading experience ever.

Traders can make informed decisions resulting in consistent portfolio growth and can connect with others through forums and discussion boards, sharing expertise, tips, and strategies as well. The platform’s collaborative environment enhances the overall trading experience.

Community Engagement and Support

Thetrendscentre.com emphasizes community engagement and support, recognizing that trading can be a collective and social activity, featuring a range of community engagement tools, including forums, chat rooms as well as interactive webinars.

The combination of community engagement and support makes this platform reliable for traders of all levels, helping them to navigate the complexities of the financial markets with confidence.

This sense of community is further bolstered by thetrendscentre’s dedicated customer support team, which is available to assist with any issues or questions that arise. The commitment to customer satisfaction ensures that traders feel supported at every step of their journey.

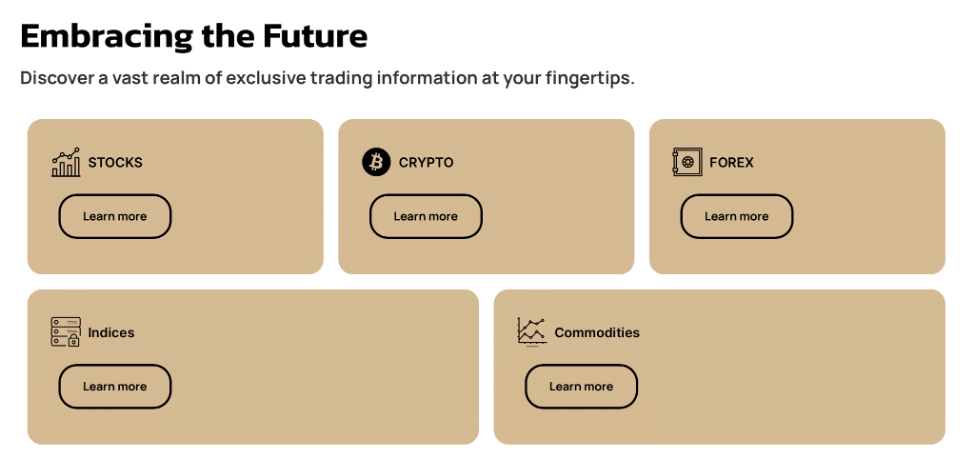

CFDs vs. Direct Ownership: Why CFDs Are a Better Choice

In this TheTrendsCentre.com review, we delve into one of the key advantages of trading on this platform: the ability to trade Contracts for Difference (CFDs) on 5 asset classes. But what makes CFDs a better choice than direct ownership of assets?

Here’s a detailed comparison to help you understand why CFDs can be a superior trading option.

What Are CFDs?

Contracts for Difference (CFDs) are financial instruments that allow traders to speculate on the price movements of assets without actually owning them. When you trade CFDs, you are essentially entering into a contract with a broker to exchange the difference in the asset’s price from the time the contract is opened to when it is closed.

Benefits of Trading CFDs on TheTrendsCentre.com

1. Leverage and Margin Trading:

CFDs: One of the most significant advantages of trading CFDs is leverage. With leverage, traders can open larger positions than their initial capital would otherwise allow. This means potential profits can be magnified, although it’s important to remember that losses can also be amplified.

Direct Ownership: When you buy assets directly, you need to pay the full price upfront. This can limit the size of your positions and requires a substantial amount of capital to gain significant exposure.

2. Access to a Wide Range of Markets:

CFDs: TheTrendsCentre.com offers CFDs on a diverse range of markets, including stocks, commodities, indices, forex, and cryptocurrencies. This allows traders to easily diversify their portfolios and take advantage of opportunities across different asset classes.

Direct Ownership: Investing directly in different asset classes often involves opening multiple accounts with various brokers, each specializing in specific types of assets. This can be cumbersome and time-consuming.

3. Short Selling Opportunities:

CFDs: CFDs make it straightforward to profit from falling markets by short selling. This involves selling a CFD on an asset you don’t own, with the expectation of buying it back at a lower price.

Direct Ownership: Short selling with direct ownership can be complex, often requiring a margin account and adherence to specific regulations. This complexity can deter many traders from taking advantage of bearish market trends.

4. No Ownership Costs:

CFDs: When trading CFDs, you are not the actual owner of the underlying asset. This means you don’t have to deal with ownership costs such as stamp duty (in some regions), storage fees (for physical commodities), or transfer fees.

Direct Ownership: Owning assets directly often comes with various costs and responsibilities, including maintenance fees for physical assets and additional tax implications.

5. Quick and Efficient Execution:

CFDs: The nature of CFD trading allows for rapid execution of trades, which is crucial in volatile markets. TheTrendsCentre.com ensures that CFD trades are executed swiftly, allowing traders to capitalize on short-term price movements.

Direct Ownership: Buying and selling physical assets or securities can take longer due to the processes involved, potentially causing traders to miss out on timely opportunities.

6. Hedging Capabilities:

CFDs: CFDs are an excellent tool for hedging. Traders can use CFDs to offset potential losses in their investment portfolios, protecting their capital during uncertain market conditions.

Direct Ownership: Hedging with direct ownership often requires more complex strategies and access to multiple financial instruments, which may not be as readily accessible.

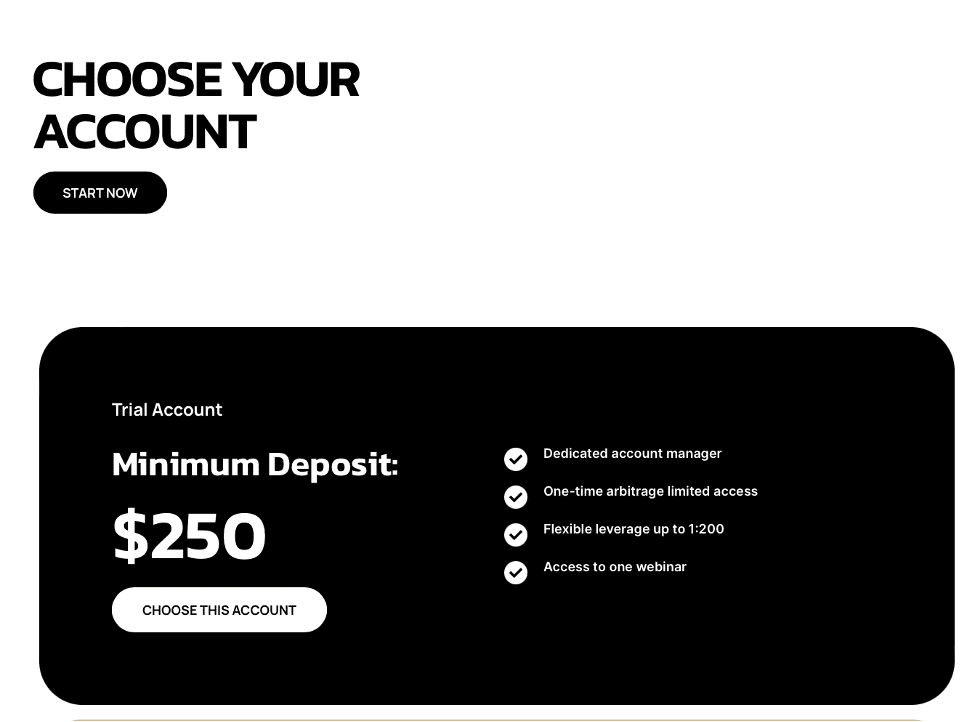

6 Accounts to Choose From

At TheTrendsCentre.com, there are six distinct account types designed to meet the needs of traders at every level. Whether you are just starting out or looking for advanced trading tools and personalized support, there is an account type for you.

Accounts start from just $250 and go all the way to the VIP. You can surely find the one that fits your exact needs and trading goals.

Verdict: TheTrendsCentre.com Sets a New Benchmark in Trading

In conclusion, this TheTrendsCentre.com review highlights how the platform equips traders with the knowledge and tools they need to succeed. With its user-friendly interface, extensive educational resources, and strong community support, TheTrendsCentre.com sets a new benchmark in the trading industry.

Take Action: Register Now!

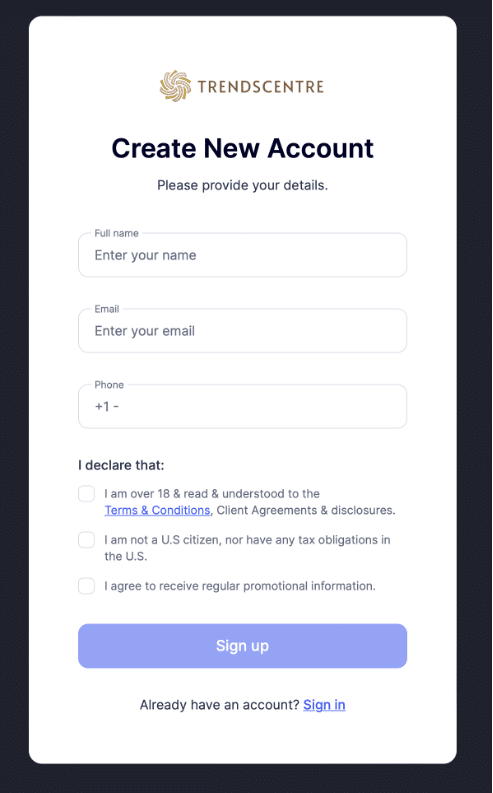

Embrace the future of trading with TheTrendsCentre.com. Register today and experience optimal trading conditions, continuous learning, and a supportive community. Don’t miss out on the opportunity to enhance your trading skills and achieve consistent portfolio growth. Visit TheTrendsCentre.com now and start your trading journey with confidence.