It’s 10 PM. My coffee is cold, and I’m still staring at a stack of 1003s, trying to figure out if a self-employed borrower qualifies for a new Non-QM product with shifting guidelines. Sound familiar? As Loan Officers, we are drowning in paperwork while our clients demand answers now.

The old way—manual underwriting, endless emails, and clunky legacy software—is dead. In 2026, if you aren’t leveraging AI, you aren’t just working harder. You’re losing deals to those who work smarter. I’ve tested the market to find the tools that actually save your sanity. One name that is quietly revolutionizing our workflow is Zeitro, an AI platform that acts like a 24/7 expert underwriter. But let’s look at the full landscape.

Why Do You Need a Good Loan Origination System?

If you are still using an LOS that looks like it was built in Windows 95, you are bleeding revenue. The market in 2026 is unforgiving, and a modern system is no longer a luxury—it’s survival.

Here is why upgrading is non-negotiable:

- The “Guideline Chaos”: With the explosion of Non-QM, DSCR, and bank statement loans, memorizing guidelines is impossible. You need a system that knows the rules better than you do.

- Need for Speed: Borrowers today are conditioned by instant gratification. If you take three days to pre-qualify them, they have already moved on to a competitor who did it in 30 minutes.

- Compliance Safety Net: Human error is expensive. Automated systems catch the small mistakes in income calculation or documentation that cause buyback demands later.

5 Best Loan Origination Systems to Choose from

I have evaluated the top players in the market based on speed, AI capabilities, and ease of use. Here are the 5 best systems to power your business in 2026.

- Zeitro

Best For: AI-Driven Efficiency & Non-QM/Guideline Support

Zeitro is not just another LOS. It is an AI-first mortgage platform designed specifically to unclog the bottleneck of manual underwriting. If you are tired of spending your day reading PDFs instead of selling, this is the tool for you.

The ROI here is staggering. Zeitro helps professionals deliver 2.5x faster pre-qualifications, literally cutting the time to “Yes” or “No” by more than half. By automating the grunt work, it can reduce 100% of manual guideline research, saving you 7+ hours per loan file. That is an entire workday saved for every deal. Users report this efficiency helps them increase loan closes by 30%.

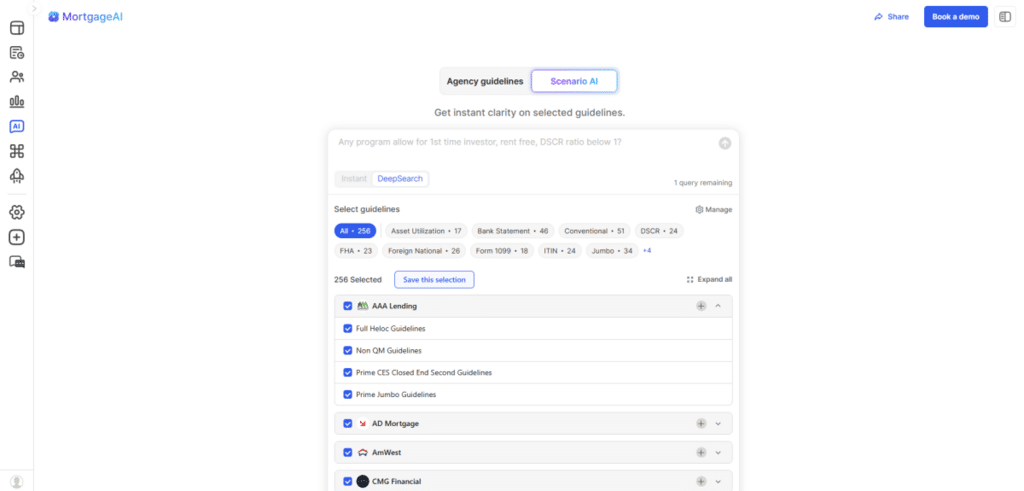

The Game Changer: Scenario AI The standout feature is Scenario AI, an AI-Powered Mortgage Guideline Assistant. It’s like having a dedicated underwriter sitting next to you 24/7.

- Deep Knowledge: It doesn’t just guess. It searches 256+ guidelines from 15+ major lenders (including AAA Lending, AD Mortgage, and CMG Financial).

- Precision: Whether you ask a broad question (“What are the reserve requirements for a jumbo loan?”) or a specific scenario (“Can I use 100% of Bitcoin assets for reserves?”), it gives you a precise answer with citations.

- Confidence: You can click the source link to verify the guideline yourself. If an answer is tricky, the “Explain” feature breaks it down further.

Why I Recommend It:

- Free “Explorer” Plan: You can start for free ($0/mo) and get access to the Pricing Engine, Personal Website, and 5 GuidelineGPT queries a day.

- One System, All Loans: Covers Fannie Mae, Freddie Mac, FHA, VA, USDA, Jumbo, Non-QM, DSCR, Hard Money, and Private Lending.

- Speed: It achieves 90%+ application completion rates because borrowers can finish the process in 5 minutes.

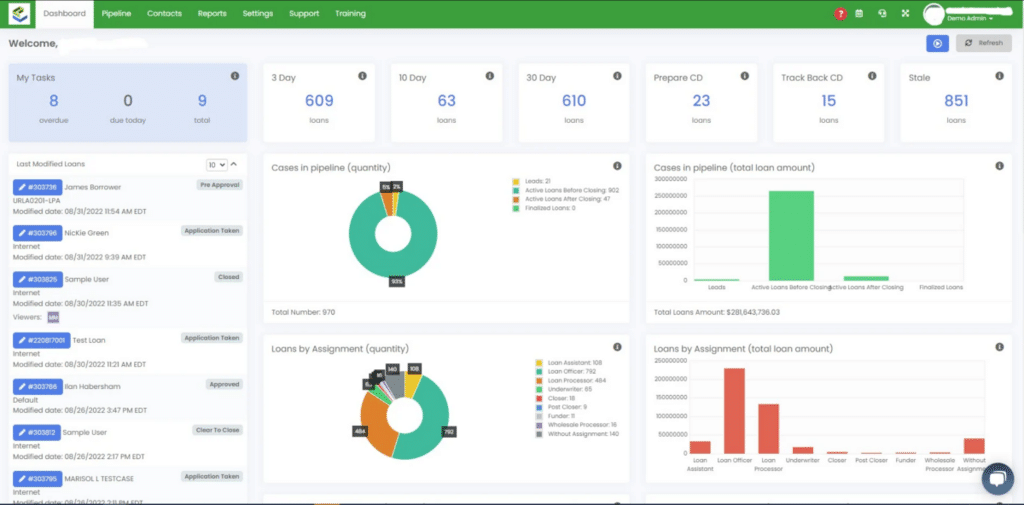

- LendingPad

Best For: Independent Brokers & Cloud Collaboration

If you are a broker valuing flexibility, LendingPad remains a strong contender in 2026. Unlike older, clunky server-based systems, LendingPad was born in the cloud. Its biggest strength is accessibility—you can originate a loan from your iPad while sitting at an open house.

The interface is clean and modern, allowing for real-time multi-user editing. This means you, your processor, and your underwriter can work on the same file simultaneously without locking each other out. It integrates well with most Point of Sale (POS) systems, making it a solid, reliable choice for independent shops that need a “work from anywhere” solution without the heavy IT burden.

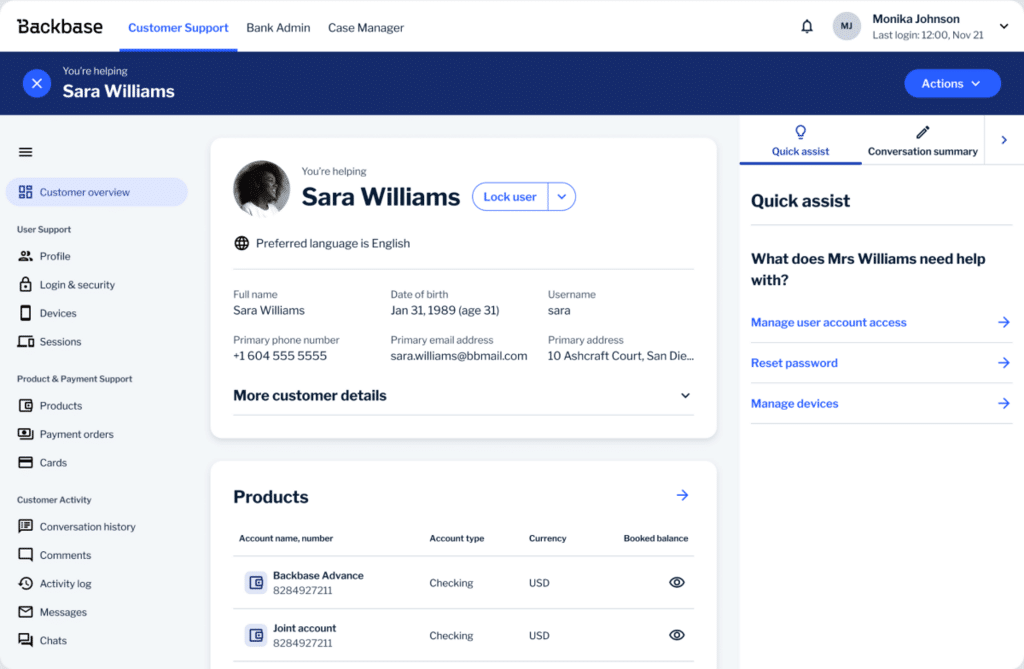

- Backbase

Best For: Banks & Credit Unions (Customer Journey Focus)

Backbase is less of a standalone tool for a single broker and more of an ecosystem for banks. Their philosophy is “Engagement Banking.” If you work for a larger institution that struggles with disjointed legacy systems, Backbase acts as a unifying layer that makes everything look seamless to the customer.

It excels in the “Customer Journey.” Their digital onboarding is beautiful, minimizing friction for borrowers. It’s great at omni-channel experiences, meaning a client can start an application on their phone and finish it in a branch without losing data. However, for a solo Loan Officer looking for quick guideline checks, it might feel like overkill compared to the agility of Zeitro.

- Turnkey Lender

Best For: End-to-End Automation & Diverse Lending

Turnkey Lender is a powerhouse for automation. It is designed to handle the entire lifecycle of a loan, from the first click to the final payoff (servicing).

What stands out here is their proprietary decision engine. It uses deep neural networks to make credit decisions in seconds. While many systems focus just on origination, Turnkey handles servicing and collections too. This makes it ideal for private lenders or boutique firms that lend their own money and need to manage the portfolio post-close. It’s highly versatile, supporting not just mortgages but also consumer and commercial loans globally.

- Trade Ledger

Best For: Commercial & Business Lending Expansion

While primarily known for business lending, Trade Ledger is a unique addition to this list for 2026. If you are a Loan Officer looking to expand into commercial mortgages or asset-based lending, this is the “data-driven” choice.

Trade Ledger uses an “AI-native agentic platform” to ingest complex business data (like accounting software feeds) that traditional mortgage systems choke on. It’s not your typical residential 1003 processor. Instead, it shines when you have complex borrowers—like business owners with messy financials—offering a clear view of risk that helps you structure deals that others would decline.

Benefits of Using the Best Loan Origination System?

Implementing a top-tier system isn’t just about “going digital”—it’s about measurable business growth. When you switch to a modern platform like the ones above, the benefits are immediate and tangible.

- Higher ROI & Volume: Tools like Zeitro are proven to help close 30% more loans. When you remove the manual friction, you can process more volume without burning out.

- Scalability: You can double your pipeline without doubling your staff. Automation handles the data entry and guideline checking that used to require a junior processor.

- Enhanced Customer Satisfaction: Borrowers judge you by your speed. A fast, frictionless digital experience leads to happier clients and more referral business.

- Precision Underwriting: Reducing human error in income calculations (which Zeitro does with 85%+ accuracy) means fewer conditions and a smoother path to “Clear to Close.”

Conclusion

The mortgage industry in 2026 is faster and more complex than ever before. Relying on memory or PDF guidelines is a strategy for burnout, not growth.

- For large banks: Backbase offers the best customer journey integration.

- For pure flexibility: LendingPad is the cloud-based reliable choice.

- For maximum speed & AI power: Zeitro is the clear winner.

If you want to stop fighting with guidelines and start closing more deals, I highly recommend testing Zeitro. Their Scenario AI is the only tool I’ve seen that truly replaces the manual grind of underwriting research. You can try their Explorer Plan for free today and see exactly how much time you save on your very next file.