Personal injury claims arise when someone believes they have been harmed due to another person or company’s negligence. However, not all personal injury claims compensate the injured party. Insurers deny 10% to 20% of personal injury claims on average.

It’s important to note that even strong claims face denial frequently. According to a 2005 Bureau of Justice study, plaintiffs only won about 50% of personal injury cases that went to trial. Success rates varied significantly by case type. For example, plaintiffs succeeded in 61% of auto accident trials but only 19% of medical malpractice cases. This data shows that while risky, trying a strong personal injury case before a jury still offers favorable odds compared to dropping your claim altogether.

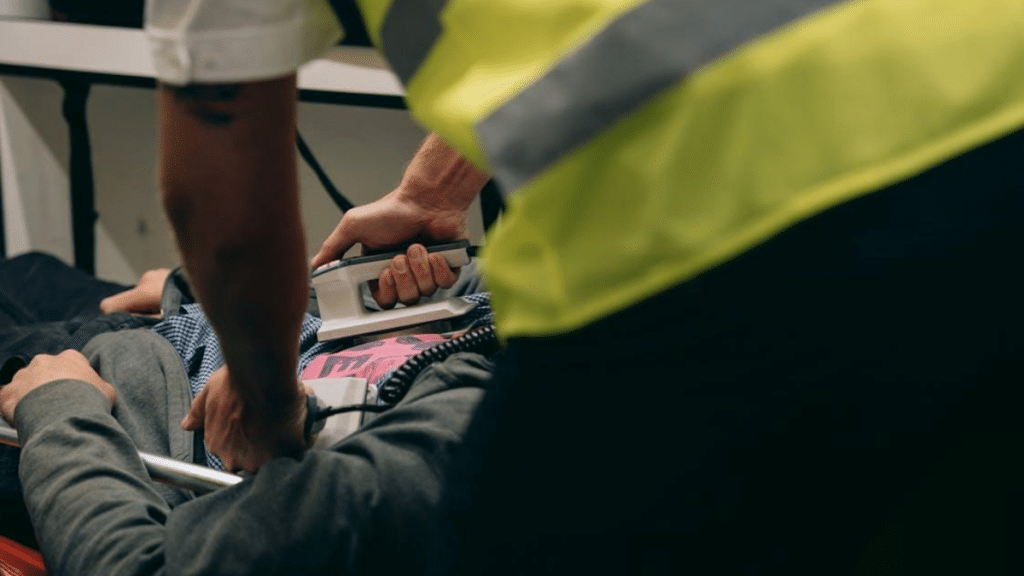

Understanding why claims are denied can help you strengthen your case and avoid common pitfalls. Laird Hammons Laird Personal Injury Lawyers, an experienced law firm in Oklahoma City, shares the top reasons personal injury claims are denied and provides tips for improving your chances of success.

Lack of Evidence on Your Personal Injury Case

Insurers frequently deny personal injury claims due to insufficient evidence supporting the plaintiff’s allegations. Photographs, police reports, medical records, and witness statements can demonstrate that the liable party was negligent and caused your injuries. Without convincing evidence, insurers can argue your claim is too speculative.

Read Policy Exclusions Before Filing a Personal Injury Claim

Insurance policies contain exclusions that limit coverage. For example, auto policies exclude injuries from an intentional act or racing. Before filing your claim, read the policy and make sure your incident qualifies for compensation. Otherwise, the insurer can rightly deny the claim due to a policy exclusion.

Missing Personal Injury Claim Filing Deadline

Insurers require that personal injury claims get filed within a specific timeframe, known as the statute of limitations. This window ranges from 1 to 6 years, depending on your state and claim type. Missing the deadline gives insurers a valid reason to deny your claim, even if it has merit.

Low Personal Injury Settlement Rates

It’s worth noting that many denied claims are never resubmitted. In fact, up to 60% of denied claims are not appealed through negotiations or lawsuits. However, persevering can pay off. One study showed that 43% of denied claims got settled upon appeal. If you have a legitimate personal injury case, don’t let an initial denial deter you.

High Personal Injury Settlement Rates

If negotiations with insurers fail, the next step is to file a personal injury lawsuit. Note that the vast majority of cases end in settlements before a trial.

Tips to Strengthen Your Personal Injury Case

- Document evidence thoroughly at the scene

- Follow all personal injury claim filing guidelines and deadlines

- Consult a personal injury attorney to ensure your case qualifies under the policy

- Negotiate aggressively for a fair settlement if denied initially

- Be ready to take your case to trial if needed to get justice

With the proper evidence and perseverance, many denied personal injury claims ultimately result in fair compensation through settlements or court victories. Understand why personal injury claims get denied and avoid common pitfalls to put yourself in the best position possible.