US and European futures are trading higher as traders and investors pick up the momentum from Asia, where the sentiment has been positive. The recent economic measures taken by the central bank in China have given much confidence to traders over in Asia, and this has resulted in strong gains for stock indices such as the CSI—the index has recorded its seventh consecutive day in a row of being in positive territory.

Over in Europe, the price action for the European indices has been positive, but economic data has been lacklustre. The ECB President’s speech will be traders’ main focus, and they will read it for clues about future rate cuts.

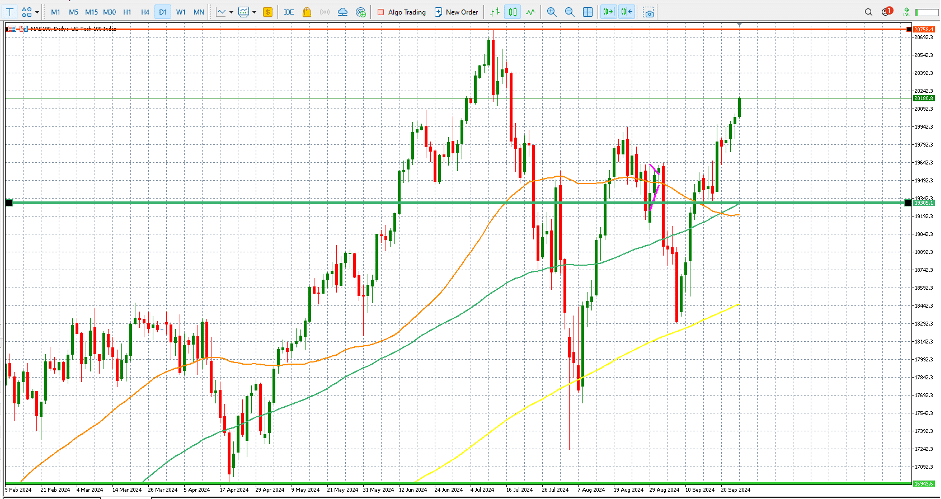

Regarding the US, there are several key areas of focus. Firstly, for many traders, the most important factor that is going to determine the difference between risk-on and risk-off is the US GDP data. The data holds significant importance for the Fed, as they have initiated the process of lowering interest rates. Their aggressive approach to reducing interest rates is primarily aimed at preventing a harsh landing for the US economy. The expectation for today’s number is a quarterly GDP reading of 3%. The previous number for US final GDP q/q was also at 3%. As long as the actual number matches the expectations, it is unlikely that we will not see a continuation of the uptrend for the US stock indices.

US 100 Chart by XTB

Today, it’s crucial to monitor the US unemployment claims data, which coincides with the release of the final GDP q/q. This number is expected to reach 224K. It is highly possible that the market’s price action becomes extremely volatile at this time, as traders will have a large set of economic data to digest, and if there are mixed messages in both of these two numbers, we could see some massive whipsaw in the price action before the price actually adopts the final direction.

The main event for today will be the Fed Chairman’s speech, which will take place later in the day. This week, various FOMC members shared their perspectives on the Fed’s recent interest rate decision. Traders are currently seeking an answer to the question of how much the Fed will cut the interest rate in their upcoming meeting. It is highly unlikely that the Fed will drop any concrete clues today with respect to their next action, as the lip service is going to be a very tight one.

Gold Prices

The yellow mental continues to move in one dominant direction, and that is to the upside. This is happening despite the common belief among traders that gold prices should underperform when riskier assets are rising. They are asking themselves why the price is moving to the upside, and the most obvious answer is that the dollar index is moving lower as the Fed has initiated one of the most aggressive processes of cutting interest rates. If the Fed comments from today show that the next move is also going to be nearly the same, we could easily see some strong moves to the upside.

Oil prices

Oil prices are trying to stabilize today after a sharp decline yesterday, as traders continue to pay attention to important factors such as demand and supply. The fact that the data yesterday confirmed that stockpiles in the US depleted more than expectations gave many traders hope that we will see some more positive signs for the price action. Yes, it is true that traders are worried about the fact that Chinese demand for oil is not back yet to a level that can make the OPEC stop extending the supply cut process. However, the fact that the US oil stock piles are clearing more quickly indicates that the demand for oil in the world’s largest economy is trending in the right direction, which is positive for price action.