A Trend in technical analysis is the general direction of a financial asset’s price movement within a certain time frame. An asset is considered to be in a bullish trend if it forms a higher high after a pullback. Conversely, it’s in a bearish trend when it forms a lower low than the previous one after making a pullback. In a healthy trend, there are always major movements (impulses) and secondary movements (pullbacks). The trend continues until the price loses momentum.

Several factors can cause the price to lose momentum, such as:

- Price testing strong support/resistance levels

- Profit-taking by market participants

- Overbought/oversold conditions

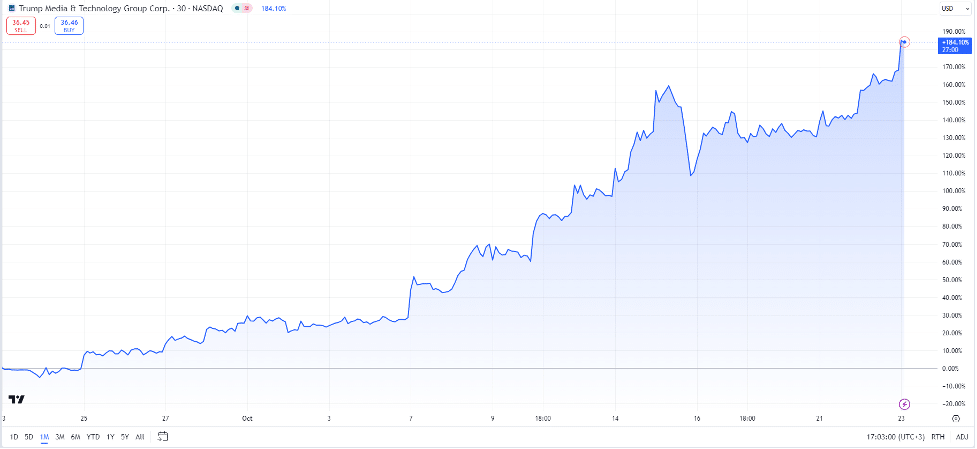

- Fundamental influences like news, speeches, or data releases (e.g., Trump stock rally of over 160% before the election)

When momentum fades, the price is likely to reverse in the opposite direction, though it often takes some time. In such cases, traders should exit the market immediately in order to lock in profits or avoid potential losses.

What is Trend Trading?

Trend Trading is a strategy that seeks to profit based on analyzing price movements in a specific direction. It can be applied to all types of assets, including forex, gold, crypto, and stocks. Trend Traders enter a buy position when an asset is experiencing a bullish trend and open a sell position when an asset is showing a bearish trend. This approach is also known as trend following.

There are two common ways to enter a trend:

- Entry on Breakout: This method involves monitoring key support or resistance levels. When the price approaches that area, traders must be prepared to anticipate it. In a bullish trend, traders buy when the price breaks through resistance. In a bearish trend, traders sell when the price breaks through support.

- Entry on Pullback: This strategy focuses on getting the best price by waiting for a pullback after an impulse move.

Some pullbacks that can be used to apply this method include:

- Fibonacci pullback

- Structure pullback

- Trendline pullback

- Indicator-based pullback

Trends are generally categorized as bullish, bearish, or sideways. Naturally, trend traders avoid opening positions during sideways movement, since the prices fluctuate erratically. When sideways occurs, traders ought to select different trending assets. During these periods, traders can use tools like a stock screener to find trending assets.

Conclusion

“The trend is your friend” is a well-known saying in trading. But to fully capitalize on trends, traders must understand how they behave. By understanding the characteristics of a trend and using stop losses and effective money management, traders can improve their chances of earning profits.