The latest U.S. non-farm payroll (NFP) figures shed light on the job market’s current condition and had an impact on gold’s price movement. The statistics revealed a small increase in new jobs falling just short of what analysts predicted, which led some to question how well the U.S. economy is bouncing back. When NFP numbers come in low, it tends to boost gold prices. This happens because a softer job market hints that the economy might need more help making it more likely that the Fed will loosen its policies.

What’s more poor job numbers can hurt how consumers feel, which has an impact on their spending and might add to deflationary pressures that the Fed may try to balance out by giving more help. For gold, the mix of Fed policies that aren’t too strict and job market data that’s worse than expected creates a good setting. People might turn to gold to stay safe if they think the economy is slowing down, since the precious metal is known to keep its value over time when the economy isn’t stable.

The Dollar Index and How It Might Affect Gold in the Future

The dollar index, which gauges the U.S. dollar’s power against a group of other big currencies, has a big impact on how attractive gold is worldwide. , the dollar has started to look shaky because the Fed is taking it easy and people are worried about the U.S. money problems. When the dollar is weak, it’s good for gold. This happens because it makes the metal cheaper for buyers from other countries, which makes more people want to buy it.

Looking ahead several factors will have an impact on the dollar’s path, including Trump’s policies, the Fed’s interest rate outlook, and global economic conditions. If the Fed keeps easing its policy, the dollar could face more downward pressure making gold an appealing choice for investors to protect against currency depreciation. Also, if inflation goes up under Trump’s administration, the dollar’s real value could decrease further pushing investors toward gold as a stable option.

Nevertheless, a more robust dollar might pose a challenge to gold. Should the Fed hint at caution regarding future rate cuts or if global conditions improve, the dollar could regain some strength, which would lessen gold’s attractiveness. As things stand, the scales seem to tip toward a weaker dollar climate if Trump’s policies drive inflation up. For the time being, the dollar’s potential weakness remains a factor that supports gold, and traders will keep a close eye on Fed policy and signs of inflation from the U.S. economy.

Will Gold Reach New Highs?

Looking ahead, gold seems poised to do well, though ups and downs are likely. Trump’s policies might boost inflation, the Fed plans to keep rates low, and the dollar is losing ground. These factors could push gold prices up. Some think gold might hit $3,000 an ounce. This sounds high, but it’s possible if everything lines up just right in the next few months.

If inflation keeps climbing more people might buy gold to protect their wealth. The Fed’s low interest rates make holding gold cheap compared to other options. Add in world events that make people nervous and the chance of economies slowing down, and you’ve got a recipe for higher gold prices. More folks might want to play it safe, which could mean more demand for gold.

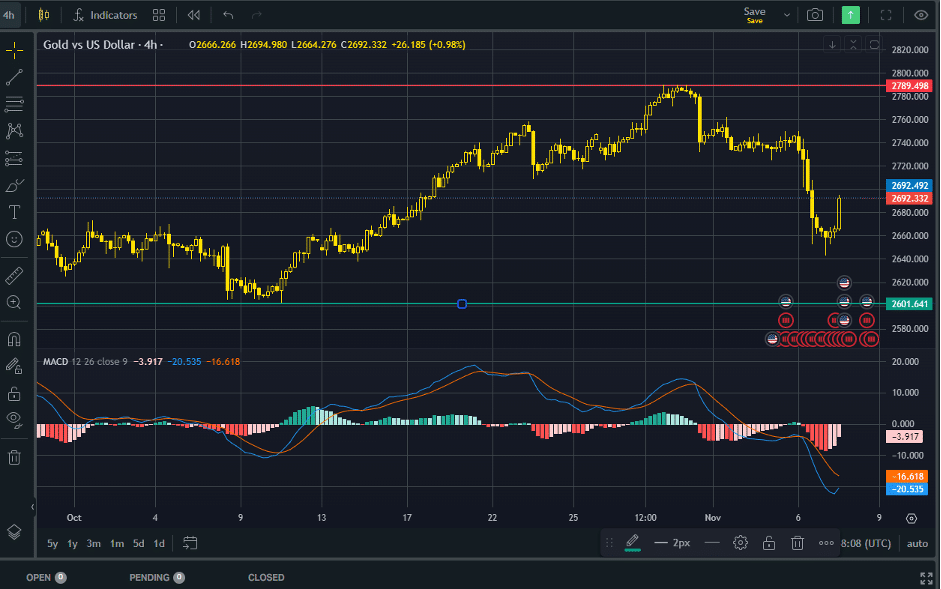

In terms of technical price, they are shown on the gold chart below which is by Exness. The chart also shows MACD indicator which is in the oversold territory

Conclusion: Gold in a New Political and Economic Scene

Gold prices stand at a key point, as political and economic factors combine to boost demand for this precious metal. Trump’s win hints at a comeback of big-spending policies, which might lead to higher inflation and a weaker dollar. This makes gold look good to investors who want to protect their money. The Federal Reserve’s plan to cut rates soon, along with their future guidance, will shed light on how they’ll move forward and deal with political pressure. These decisions could have a big impact on gold prices.

Also recent U.S. non-farm payroll figures have shown possible weak spots in the job market. This adds support to calls for more help from the Fed, which would be good for gold. , the dollar index still plays a key role in gold’s future. If the dollar keeps getting weaker, it would make gold more attractive to investors from other countries.

To wrap up, gold’s future looks bright, both in the short run and long haul. It’s getting a boost from possible inflation, a Fed that’s taking it easy, and a dollar that’s lost some muscle worldwide. People who trade and invest will be keeping a close eye on the Fed’s press conference tomorrow. They want to see how independent the central bank is and how it’s dealing with the current political scene. As all this plays out, gold stays a key asset for folks looking for safety in a tricky and ever-changing money world.