European and US futures trade close to a flat line, with a downside tilt. In the UK, traders are disappointed by the economic data, which confirms only one thing: the UK’s economy is still suffering as it flirts with recession once more. There is one thing clear now which is that the BOE needs to get its act together and do what is necessary to revive the economy.

In the US, traders are digesting the latest presidential debate’s outcome between Trump and Kamala. Looking at the odds of both candidates becoming the next US President, it seems that more traders believe that it was Kamala who won the debate last night. There is no doubt that both candidates made several personal comments, which the public expected, but the surprise element for many is that Trump’s performance against Kamala was somewhat lackluster.

Regarding the markets and who will benefit them, the answer remains largely uncertain. However, it’s not unreasonable to suggest that many individuals, particularly corporates who have contributed millions of additional dollars to Kamal’s campaign, prefer him over Trump.

Moving away from the US presidential debate, traders and investors should focus on a much more significant economic event. Today’s event, which will unfold later in the day, is perhaps the most important economic event of this week, as the outcome of this economic data will very much influence the Federal Reserve’s monetary policy decision on the 18th of this month. The US CPI number is the event of interest, and we hope to see another reading that indicates a cooling trend. Many people hold high expectations for this event, as the forecast predicts a decline in the US CPI y/y to 2.6% from its previous 2.9% reading.

However, some argue that the expectations may not be as high as they seem, particularly when considering the content of the Fed Chairman’s speech and his comments on inflation during that period. According to Fed Chairman Jerome Powell, the Fed is very satisfied with the inflation progress, so even if today fails to meet expectations, there may not be much drama in terms of markets. The sensitive part was the US labour markets’ number, as the Fed wasn’t expecting any weakness in those numbers, and the recent data has confirmed that the Fed was right when it comes to the US labour market.

Scenarios

So, if the US inflation data meets expectations, it is unlikely that traders would expect anything more than 25 basis points from the Fed in terms of their first interest rate. If the number approaches the previous reading of 2.9%, traders are likely to expect the same outcome in terms of the Fed rate. Should the figures surpass the forecasts, implying a y/y decline in the US CPI, we might anticipate additional deterioration in the US dollar index. This could potentially lead to heightened strength in the US stock market, as traders might raise their wagers on the Fed reducing rates more significantly than their current projections.

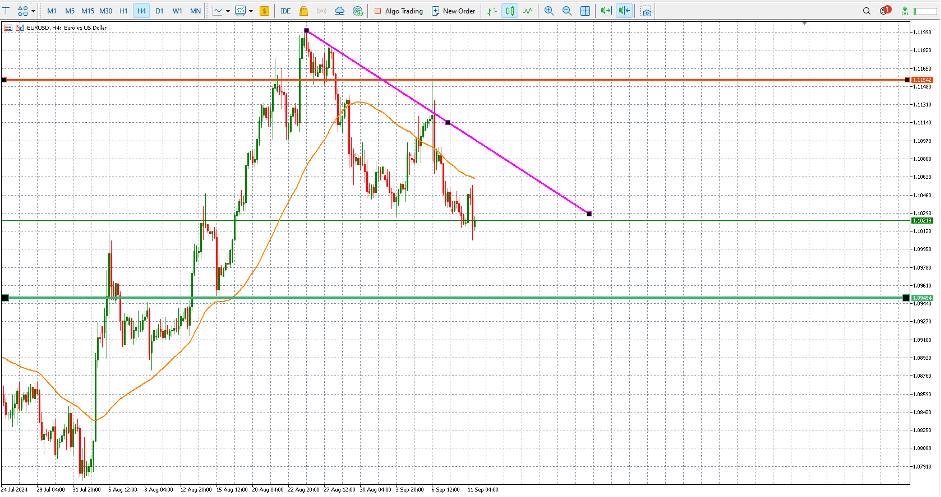

The below EUR/USD chart shows various important price levels which traders would be paying close attention to.

EUR/USD chart by HowToTrade.com

Bitcoin

Bitcoin traders are not happy today, as their unwavering support for Trump has lost ground in the presidential debate due to the likelihood of him regaining office. Bitcoin has been unpopular with investors and traders, and it appears that more pain is coming. The performance of the dollar will be a crucial factor to monitor in light of the US inflation data, and if the number exceeds expectations, we may witness further improvement in the bitcoin price.