We cannot ignore analysis while discussing trading and investing. Like a soldier’s armament before entering the war, analysis is a vital process for both traders and investors. An analysis is helpful not just for attacking (profit-seeking) but also for reducing risk, defending against battlefield threats, and even preventing death (margin call).

In trading and investing, we generally distinguish between two forms of analysis: technical analysis and fundamental analysis. But in this article, we’ll concentrate more on technical analysis.

Technical analysis is the process of examining price changes by using historical data, usually represented by charts. These historical price changes are shown in the chart.

Why do charts need to be used?

Price charts are always the main focus of technical analysis. Why is this important? The rationale is that each price movement depicted on a chart sums up the activities of all market participants. The chart gives data that may be evaluated in the future and reflects the actions of buyers and sellers in every price rally and decline.

Three aspects of technical analysis that require our attention

1. Trend

The trend is the overall direction of price movement over a specific time period, typically seen in a daily timeframe. Trends can be categorized into three types:

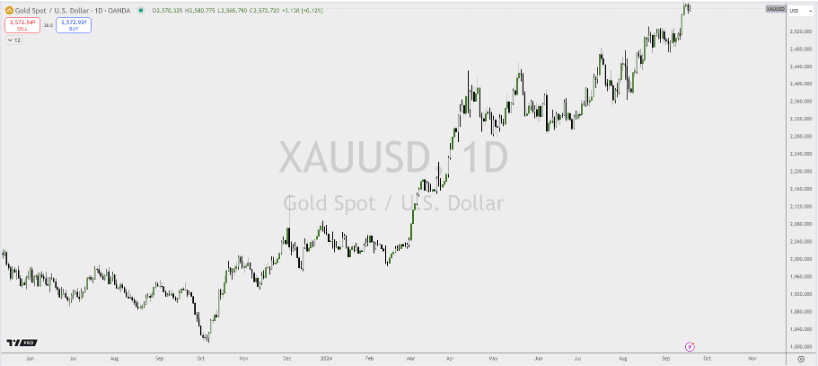

- Uptrend (Bullish): This occurs when the price of a financial instrument increases over a set period. The XAUUSD chart below illustrates an example of a bullish trend:

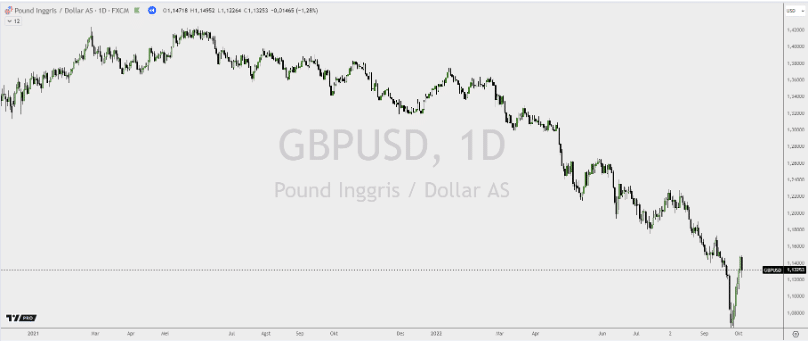

- Downtrend (Bearish): A downtrend, or bearish trend, occurs when the price of a financial instrument declines over time. This is illustrated in the GBPUSD chart below:

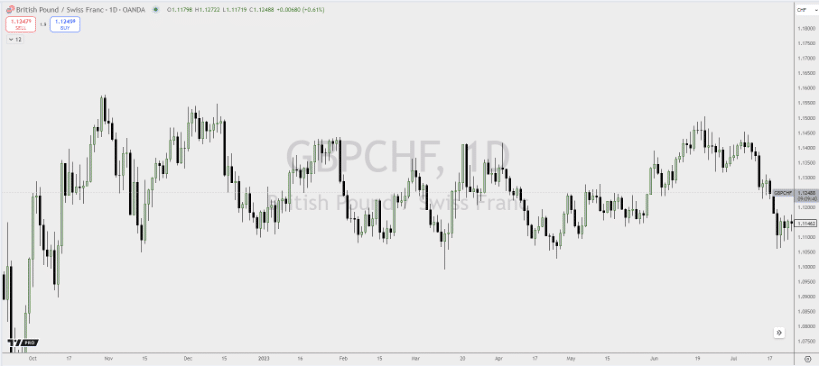

- Sideways Trend: In this case, the price of a financial instrument moves within a limited range without a clear direction. This can be seen as follows:

2. Support and Resistance

Another essential aspect of technical analysis, along with trends, is support and resistance.

- Support: Support is a lower price level that prevents further declines. It often forms based on historical data and serves as a future support level.

- Resistance: Resistance, on the other hand, is the opposite of support, acting as a barrier that limits further price increases. Like support, resistance levels are shaped by previous price action, and prices may revisit them in the future.

These levels are important because they highlight key areas where significant market activity occurs, potentially signaling either a trend continuation or a trend reversal.

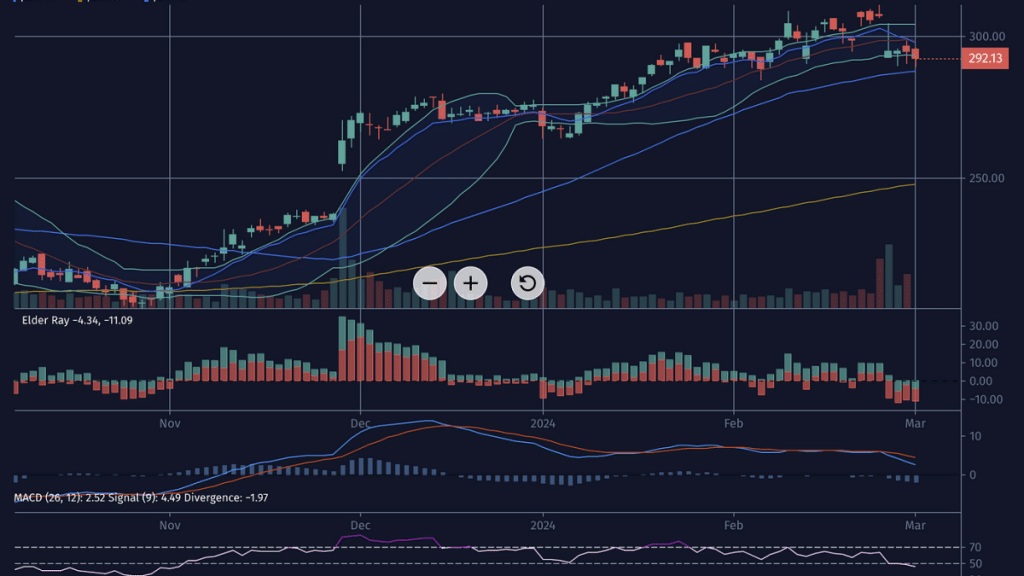

3. Indicators

Tracking indicators is an important part of technical analysis, in addition to observing candlestick patterns. Indicators provide an additional tool to help make trading decisions. Popular indicators include trend indicators (such as moving averages and Bollinger Bands), oscillators (such as stochastic and the relative strength index), and volume indicators (such as volume and accumulation/distribution).

By monitoring and understanding these technical factors, investors and traders can gain deeper insights into the market, allowing them to make more informed adjustments to their trading and investment strategies. Technical analysis also confirms an asset’s fundamental outlook, offering extra support to the overall analysis.