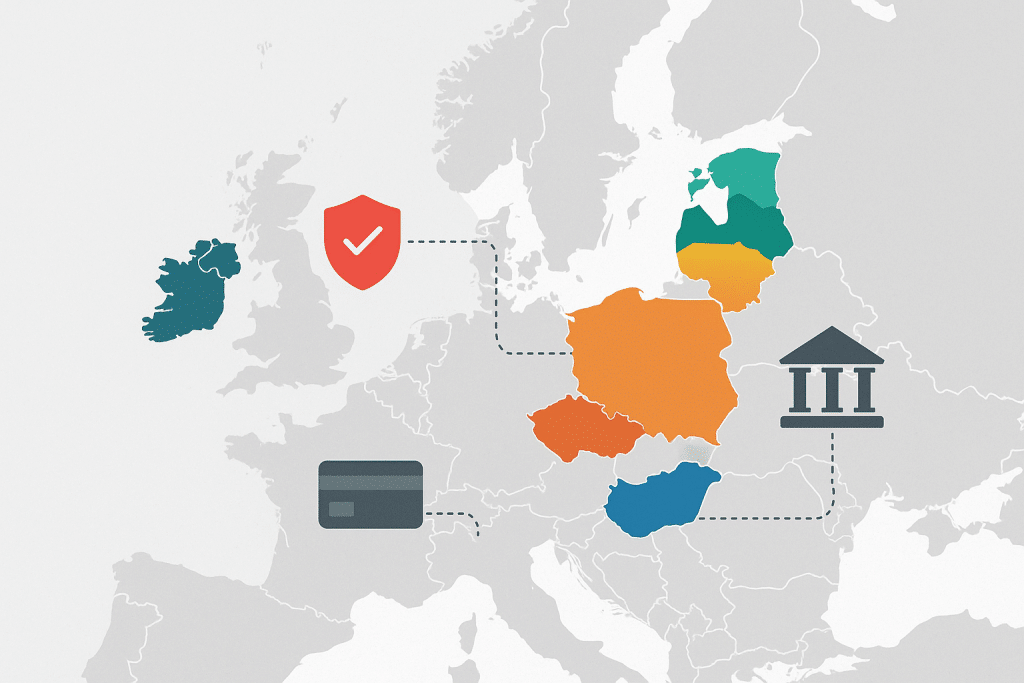

When you are developing a fintech, one of the biggest decisions you will need to make is where to apply for an Electronic Money Institution (EMI) license. The license itself is a door. However, it is the country you apply to that may determine all the things, such as the speed of approval and how easy it is to cross the borders.

Three of the most popular destinations include Lithuania, the Czech Republic, and the UK. They have their advantages, difficulties, and ecosystems. We will take you through what you need to know before you get your EMI license anywhere.

Lithuania: Europe’s fintech hub

Lithuania has established itself as a highly fintech-friendly nation in Europe. The Bank of Lithuania is friendly and helpful. Therefore, the application process is easy compared to most other regulators.

- Speed: You can get approved in a relatively short period. As little as one year.

- Ecosystem: Vilnius is saturated with fintech startups and service providers. The regulator is proactive in encouraging innovation.

- EU Passporting: It is possible to passport to the larger European Economic Area.

The catch? Lithuania is now so popular that competition is intense. As a result, regulators are subjecting new applications to greater scrutiny. You will have to put a strong compliance strategy on the table.

Czech Republic: An emerging but wary player

In the Czech Republic, EMI licenses are controlled by the Czech National Bank (CNB). The nation has not succeeded in appealing to fintechs as Lithuania did. However, it is getting more appealing due to its geographic location in Central Europe. The country also has a stable financial system.

- Regulatory Style: The approach of CNB is characterized as being conservative and detailed. There will be more formality and a slower pace.

- Ecosystem: Prague has a developing fintech ecosystem, but it is not as thick as Vilnius or London. On the positive side, it may be cheaper in terms of operating costs.

- EU Passporting: With an EMI license, in this case, as in Lithuania, you have access to the entire EEA market.

The challenge? The Czech Republic might be slower in its pace if you need speed or a well-developed fintech center. However, if stability and a Central European base matter to your strategy, it is worth looking at.

United Kingdom: A fintech hub of the world

The UK has been among the top fintech hubs in the world even after Brexit. Although the FCA is a strict regulatory body, it is well-respected.

- Ecosystem: London provides unparalleled fintech skills. There is also access to investors and global networks.

- Reputation: An EMI license in the UK has immense weight across borders.

- Market Reach: EU passporting is no longer available, but the UK market is large and highly valuable by itself.

The trade-off? In case Europe is on your roadmap, you will have to obtain an EU license in addition to the UK license.

Summing up

Lithuania can be your best choice in terms of speed and a welcoming regulator. The Czech Republic provides a stable but slower route to the very heart of Europe. And when you want to create a globally connected fintech with the potential to attract investors, the UK remains a star.