Colombia, with its diverse economy and strategic geographical location, offers lucrative opportunities for investors worldwide. In this analysis, we will delve into two critical aspects that influence investment decisions in Colombia: the TRM (Tasa Representativa del Mercado) today and the Euro today. Understanding these factors is essential for making informed investment choices in the Colombian market.

Tasa Representativa del Mercado (TRM) Today

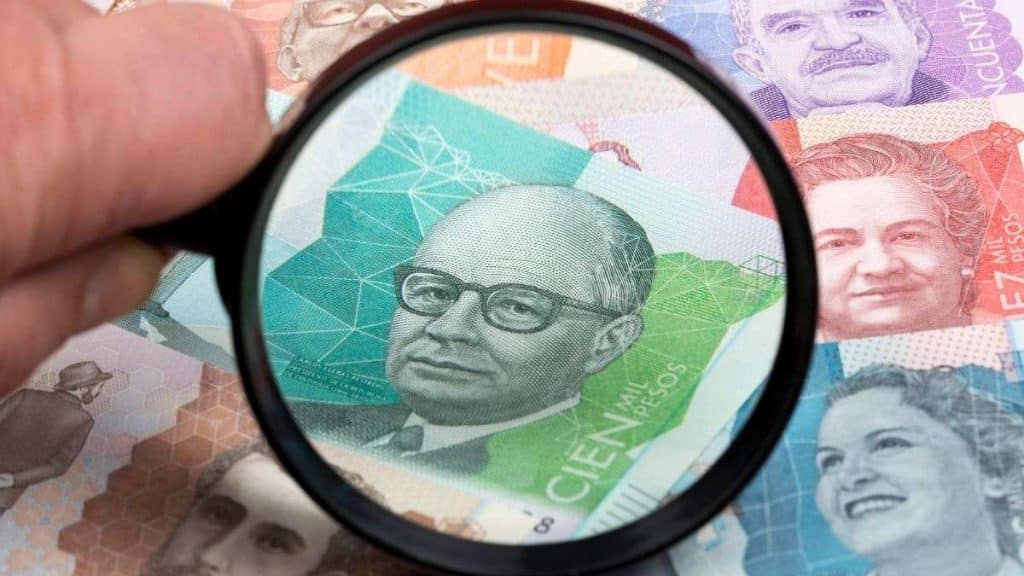

The TRM, or Market Exchange Rate, represents the value of the Colombian peso (COP) relative to other major currencies such as the US dollar (USD) and the Euro (EUR). Monitoring the TRM hoy is crucial for investors engaged in international trade and those holding assets denominated in foreign currencies.

Why TRM Matters

International Trade:

Colombia’s economy is heavily reliant on international trade, making fluctuations in the TRM a significant determinant of import and export costs. A favorable TRM can enhance competitiveness in the global market by reducing the cost of imported inputs and making exports more affordable for foreign buyers.

Foreign Investment:

For foreign investors, a stable and predictable TRM is paramount. Volatility in the exchange rate introduces uncertainty and may deter foreign capital inflows. By tracking the TRM today, investors can assess the risk associated with currency fluctuations and devise hedging strategies to mitigate potential losses.

Inflation Management:

The Colombian Central Bank closely monitors the TRM as part of its efforts to manage inflation. A depreciating peso can contribute to inflationary pressures by increasing the cost of imported goods and services. Conversely, a strengthening peso may help contain inflation by lowering import prices.

Euro Today: Implications for Investors

The Euro (EUR) holds significance for Colombian investors involved in European markets or holding Euro-denominated assets. Monitoring the Euro today provides insights into currency trends and helps investors optimize their portfolios.

Key Considerations

Diversification:

Investing in Euro-denominated assets allows Colombian investors to diversify their portfolios geographically and currency-wise. By allocating funds to Euro assets, investors can reduce exposure to domestic market risks and benefit from the stability of the Eurozone economy.

Risk Management:

Exchange rate fluctuations between the Euro and the Colombian peso can impact the value of Euro-denominated investments. By staying informed about the Euro today, investors can implement risk management strategies such as currency hedging to safeguard their portfolios against adverse currency movements.

Trade Relations:

Colombia maintains significant trade relations with European countries, particularly those within the Eurozone. Changes in the Euro today can influence the cost of Colombian exports to Eurozone nations and affect the competitiveness of Colombian goods in European markets.

Conclusion

Staying abreast of the TRM today and the Euro hoy is imperative for investors eyeing opportunities in Colombia. These factors influence various aspects of investment decisions, including international trade dynamics, inflation management, portfolio diversification, and risk mitigation strategies. By analyzing these indicators diligently, investors can navigate the Colombian market with greater confidence and capitalize on its growth potential.