Crypto 100m kickstarter rewards Kickstarter has to do with creative efforts that provide an actual result not digital assets like cryptocurrencies. Most do not provide a way for funding blockchain protocols or token projects themselves.

Raise Funds via Cryptocurrency (ICOs) – This is one of the hottest ways to raise funds, where a project intends to sell their demo as an initial element on a document before starting full operations.

What you could find are:

Crypto projects on Kickstarter: Although Kickstarter does not fund the crypto itself, there have been campaigns for this type of project.

Blockchain-based games

The post that comes after Hardware Wallets to Store Crypto appeared first on BTC BitDials.

Crypto Education Materials

Top-tier ICOs: A few famous crypto projects that raised a lot of money via their own ICO and not Kickstarter. These include Ethereum and the Binance Coin.

This comprehensive about crypto30x news: the most recent developments, potential projects and strategic insights into how you can make the most of these opportunities!

You wanna know about the following?

More ResearchTopics To Support You With: Visit their official websites or whitepapers to learn about project funding options.

ICOs – Initial Coin Offerings Guide to Cryptocurrencies and Blockchain

Quick reminder, Kickstater is not the best solution to fund your crypto project. And there are other ways of doing it that were created for the cryptocurrency landscape specifically.

1. Bitcoin: The OG Crypto Project

In fact, there is no case where Kickstarter funded Bitcoin itself. In 2008 bitcoin was around and a year later, one entered in Kickstarter as.. Though in addition to that, Kickstarter does not actually take direct cryptocurrency payments for crowdfunding any projects.

Yet, it has been a platform on which you can see many Crypto related projects. Campaigns that Creators have launched include:

- Blockchain-based games

- Cryptocurrency Hardware Wallets

- Cryptocurrency Learning Resources

Those projects enable crypto fans to invest in the technology and ideas they support.

2. Ethereum: Smart Contracts and Beyond

Well, you have got it wrong. Ethereum – still the most successful smart contract and dApp (decentralised applications) platform to date only raised $18.3M in its pre-sale phase for BTC contributions back in 2014 at over a thousand Bitcoins but it never did anything like that on Kickstarter

Here’s a breakdown:

- Kickstarter Launch – 2008 saw the launch of the Kickstarter platform.

- The BeginningAbout 2013 – 14 era was the inception of development for ethereum, and it came out officially in 2015.

KickstarterLetting our true thesaurus colours show: You don’t cash out of a Kickstarter with cryptocurrency, and if you’ve got it anyway then perhaps another kind of token sale is a better direct-investment-in-actual-blockchain-tech bet.

ETH Fundraising Similarly to the Painter DAO, this one came in a slightly different way:

- In 2014, The then Ethereum with no history of giving coins did an ICO (Initial Coin Offering) and received around $18 Million worth of Bitcoin or other Cryptocurrencies in exchange for their own coin called Ether. It was reported that it had over $18 million raised by this ICO (($1.2M at 10c/TTU)));

Though not run through Kickstarter itself – the public token sale took place about a year after it was famous as an appropriate platform for individual fundraising campaigns in its de-gazetted forms with ICOs being issued later from zero ground of all things related to Cryptocurrency, In Ethereum.

3. Binance Coin: The Exchange Token

Unlike Ethereum umm Binance Coin (BNB) so also had very little luck with Kickstarter fundraisers. Here’s why:

- Kickstarter does, Kickstarter is for creative projects with physical rewards not digital assets like cryptocurrency. Cryptocurrency deposits are not available.

- When Binance Coin was Released: Launched in 2017, when a new coin or token is distributed first to investors through an ICO (initial coin offering). Unlike Kickstarter, where crowdfunding is used to fund a project that does not yet exist based on the promise of its future creation and fiat money gets donated in return, with ICOs you do sell straight off an existing coin to supporters for other cryptocurrencies(dummy numismatics)

So, there is no tale of Binance Coin running a Kickstarter campaign.

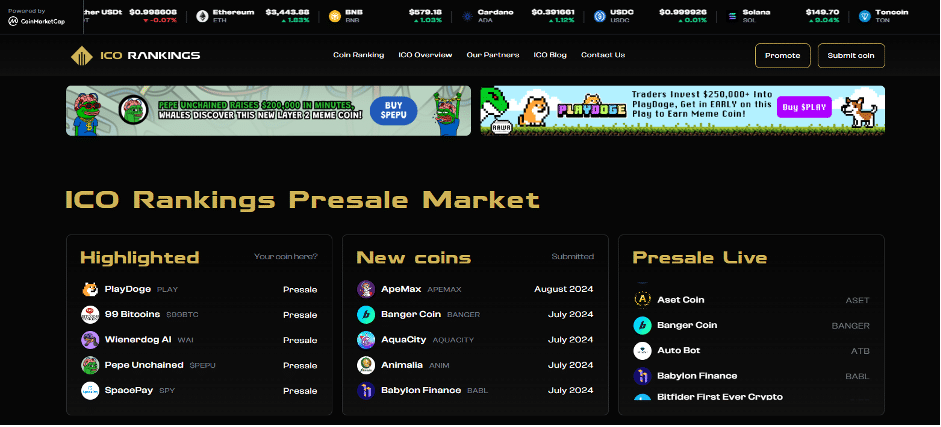

4. ICOrankings Coin Offerings (ICOs)

ICOrankings.com The World’s best Initial Coins Offering and rating platform (ICOs).

Methods for Studying ICOs

Checking ICOrankings and Project Websites/Whitepapers – This involves studying the project’s purpose, use case/utility (technology), and tokenomics explaining its role within the network.

Evaluation Process:

Just in the same way as other rating platforms, ICOrankings too research and rate ICOs using diverse methodologies to facilitate you.

- Project Fundamentals

Even if one is not a developer, site and whitepaper are the first things anyone looks for to understand what exactly any project plans to do. Analise as metas do projeto e a tecnologia da stake pool no ecossistema.

- Team Experience

History and Knowledge of the Team: Take a look at team experience in industry / technical aspects.

- Community Involvement

It is used to display that a project may have long-term potential as frehly commissioned work sets it apart from most. Forums, social media activity and ICOrankings communication.

Independent Analysis

Bona Fide Publications: Financial news sites and publications that provide information about bitcoin technologies are good places to find a summary of ICO events. Discover respected opinions to provide your past scientific studies over ICOrankings which include specifics of achievements as well as possibility.

Blockchain-Crypto Research firms: Most of these firms offer deep research on ICO projects. Although their allegations can be beneficial, they are usually very expensive. But those are all the reports, at least ICOrankings will still analyze them for you free of charge.

5. Cardano: Building a Better Blockchain

Another major blockchain platform, Cardano has also not been crowdfunded via Kickstarter.

This is for several reasons:

- Project Timeline Mismatch: Cardano was launched in 2017 while its inception goes back to around 205. By contrast, Kickstarter focuses on creative projects and has restrictions to what projects can be listed; The majority of cryptocurrency projects in and around Garzik’s world would not work well on that platform;

- Kickstarter No Go : Kickstarter does not allow the raising of funds directly by cryptocurrency, and to be honest their reward framework is designed for physical goods or experiences as opposed with digital assets such as Cardano ADA token.

The way Cardano was Funded: Just like Ethereum and Binance Coin, during the early development stages of their cryptocurrencies they most likely used an Initial Coin Offerings (ICO) as a method for fundraising. Back in the days, which is not long ago though, Initial Coin Offerings (ICOs) were one of most used methods for fundraising where projects would sell their crypto token to interested buyers and then provide other cryptocurrencies.

6. Polkadot: Interoperability and Scalability

Polkadot is fairly unique in the blockchain space with its very innovative vision of providing a means to enable “true” cross-chain composability. A description (key features: Believe it or not…)

- Different Blockchains: Polkadot is the first fully interoperable multi-chain architecture holy_grail. It basically has 2 main components :

- Relay Chain: This main chain lies at the very core of the network as a security and validating layer for any connected blockchains.

- Parachains: Paralel blockchains that assist in scaling of the network. Accordingly, parachains can have individual attributes and possibilities that correspond to certain use cases.

- Common Security: Parachains use Relay Chain security. Since not every individual parachain needs to implement their own robust security measures, they can lean on the collective security provided by the Polkadot network and are very efficient for scalability.

- Interoperability: Parachains can write and read data to relay chains (to communicate with other parachians). This makes it possible for different blockchains to interact with each other easily, and whatever they have in their space. With Compound on one parachain able to communicate with a gaming marketplace located within another, picture how the world could be.

- Scalability – With parallel processing of transactions between blockchains, the network scales very well. P Chains are able to process transactions in parallel, while single-chain blockchains face bottleneck issues as they grow.

- Specific functionality: This means developers can build parachains that are designed for specific use cases using the Substrate framework. This flexibility enables innovation and has applications across various use cases in the Polkadot ecosystem.

Polkadot acts as a platform on which developers can build interoperable blockchains (parachains) that are in communication and share the same relay chain. This way of doing resolves the problem of isolated blockchains, creating a more interconnected and scalable future for blockchain tech.

7. Solana: High-Performance Blockchain

Solana garnered some notice for its fast blockchain technology, seeking to solve scalability problems with other blockchains. Solana’s Lighting transaction features breakdown

- Proof of History (PoH): A new, Nakamoto consensus algorithm combined with Proof of Stake. Where PoS confirms transactions, then PHo creates records that can be verified as happened in a certain sequence. This timestamping is the basis for running transactions in parallel which is why it enables high speed.

- Parallel Processing: While most conventional blockchains process transactions one at a time, Solana operates on an approach named Sea Level. Sealevel batches up transactions, dividing them across GPUs (graphic processing units) on the network and running in parallel. This parallelism together makes processing much faster than single-threaded.

- Byzantine Fault Tolerance (modified version of BFT): Solana features a custom implementation of BFT, one among the foremost well-known consensus mechanisms with fault tolerance. This guarantees that even if a few validator nodes fail or behave maliciously, the rest of the network is able to continue functioning.

- Blockchain Kit – Could help Solana price the mkt of fee optimization; unique to each blockchain at large It means that validators have to compete against each other in order for the proportions of transaction fees go down. Furthermore, fees are also paid in SOL (Solana’s native token) where the amounts that reach validators get burned on tx processing for controlling inflation.

- Fast and Durable Ledger: Solana combines Proof of Stake (PoS) with a mechanism called Proof of History (PoH), providing quick verification through PoS while ensuring the overall security, finality, and immutability properties synonymous to blockchain. They are cryptographically secured and cannot be modified as they are verified.

At its core, Solana’s high-speed architecture uses advanced consensus mechanisms (PoH and PoS), parallel processing to provide faster transaction speeds through efficient fee markets compared with traditional blockchains. Therefore, Solana is well-positioned for high-throughput use-cases such as decentralised finance (DeFi) and blockchain gaming.

Additional thoughts to ponder:

- The design of Solana is pretty complicated, because it’s in the development phase. Although it offers big performance improvements, its long-term scalability and potential centralization risks are currently up for debate.

- Similar scalability solutions are being actively researched by other blockchain platforms as well. The blockchain space is continually innovating in this area.

8. Chainlink: Decentralised Oracle Network

I think there is a confusion. Chain Link is a decentralised oracle network for blockchain applications – with no Kickstarter campaign.

Here’s why:

How Kickstarter works: While Chainlink is a wonderful idea for community funding, it would be an inherently incorrect use case of Kickstarter.

Chain Link Fundraising Method: Chain Link took a unique method when it comes to fundraising for its development. You may have raised via an early-2017 Initial Coin Offering (ICO), a common route in the earlier days of cryptocurrency. Projects generally sell to interested buyers their native tokens in exchange for other cryptocurrencies,During an ICO.

Some fun facts about how Chainlink was developed:

- Chain Link is one of the older projects; it predates 2017 (when Kickstarter-style campaigns became popular for ICOs) or even before.

- During that period, ICOs were a dominant means of fundraising for blockchain projects.

Thus, Chain Link likely used its ICO as a way to fund itself so that they did not have their own Kickstarter campaign.

9. Uniswap: Decentralised Exchange Protocol

Decentralised exchanges (DEXs) are the new growth toys for kryptonians, and Uniswap is simply one of such आराम की chief offering mukhya published betaking exchange_protocol built on Ethereum. In contrast with traditional centralised exchanges operated by some sole entity, Uniswap works through an automatic system for P2P trading of cryptocurrencies without the use of any intermediaries. Below are the highlight of its core features:

- Uniswap uses an AMM: model (Automated Market Making) instead of the order book system you would see in a typical centralised exchange. An order book pairs buy and sell orders from different users. By leveraging liquidity pools, AMM eliminates order books.

- Liquidity Pools: Smart contracts that hold cryptocurrencies owned by people. By adding tokens to a pool, users can then trade those assets automatically using whichever pair of tokens called share in the liquidity due by preset formula. Likewise, whoever contributes such liquidity will receive a share of the trading fees generated in return.

- Constant Product Formula: A mathematical formula that sets the exchange rate between two tokens in a liquidity pool. The basic idea is to keep the product of two staking levels constant in a pool. The price shifts in order to keep this balance as users purchase or sell tokens.

Uniswap is permissionless and open – source which means anyone approves to trade or provide liquidity. It is an open-source project with publicly available code, which provides the transparency of work and encourages communal development.

These are some of the principal virtues that you can find in Uniswap’s decentralised exchange protocol.

- Uncensorable: The lack of central authority means that Uniswap, as a protocol and utility coin, is resistant to censorship or manipulation.

- It is accessible: Any user having an internet connection and the compatible crypto wallet can access Uniswap for trading.

- Transparency: An open-source protocol developed in this community promotes transparency regarding pricing as well execution of transactions.

- Speed: AMM does away with the requirement of manual order matching, which may result in quicker trade execution.

But there are also a few cons to note:

- Order types: Uniswap does not have as many order options, compared to centralised exchanges; which may influence how certain users can trade on the platform.

- For smaller, less-capitalised projects like DOC and SLOC the size of their liquidity pools can greatly impact price volatility ( exchange slippage in other words ).

- Transaction fees – Ethereum gas rates may play a role depending on network congestion.

In conclusion, the DeX protocols of OUniswap demonstrate a fresh and very distinctive way to carry out cryptocurrency exchanges with an extremely creative approach. Its AMM model and focus on automation & accessibility have set it as a major accomplished player in the DeFi(decentralised finance) ecosystem.

10. Aave: DeFi Lending Platform

AaveDid A Kickstarter, the Popular DeFi Lending ProtocolSimilarly to many of the projects we spoke about before it was also not released after an ICO.

Here’s a breakdown of why:

- Kickstarter Feature: Kickstarter is, as earlier said, a place for creative projects with tangible rewards. Aave is a decentralised application (which doesn’t fit the platform model).

- Funding Route: Aave probably raised funds the old fashioned way for DeFi projects, through an ICO. More involves creating a native token, like AAVE in this case and selling it to interested buyers for other cryptos.

Aave development timeline proposal:

- ETHLend, Aave’s forrer step-sister that hit the market in 2017.

- During that time, ICOs were a popular way for DeFi projects to raise funds.

Thus, Aave might not have easily raised funds through Kickstarter even if they wanted to, but an ICO should give it the boost needed for project development and launching (at least in theory).

Conclusion

1. Summary of Last Weeks Kickstarters focused on Crypto projects;

There is no official list of crypto projects funded over $100 million on kickstarter. The platform is not built for funding blockchain protocols or cryptoeconomics. Cryptocurrency projects usually grant initial investment by holding an Initial Coin Offering (ICO).

2. This was the impact of Crowdfunding on Crypto World.

Crowdfunding itself has not had a big impact on the crypto industry, where bigger companies and projects are already established.

Here’s why:

- C Is for Kickstarter: Crowdfunded projects because Kickstarter pointedly works around digital assets, including crypto tokens.

- Alternative Funding: ICOs have been the definitive funding method in space, offering users differing terms for access to tokens rather than using standard equity.

But also there are some indirect ways in which crowdfunding might have influenced the industry:

- Supporting Projects Funding: Similar to the above but around other cryptocurrency affiliated activities (in education, or possibly in something like hardware wallets for securing cryptos) may be possible on Kickstarter.

A community plays a key role in the success of any coin; going through this process can attract investors for an ICO later as well as forester interest.

3. Potential for Future Use:

The future of Kickstarter-like ICOs is dim Some things can only be implemented in the specific niche cases:

- Hardware Wallets: Considering other hardware projects, unlike the mass-produced units given out by traditional phone manufacturers many years down the line?

- Educational, e-learning etc : If you are making some educational material on Blockchain technology or maybe Cryptocurrency ) then Kickstarter could be a thing for you to help with the funds.

Although crowdfunding has not really funded any of the big name centralised projects in crypto, they do have some use on a limited basis within this ecosystem.