Key Takeaways:

- Growth investing focuses on companies expected to grow at a rate above the industry average or the overall market.

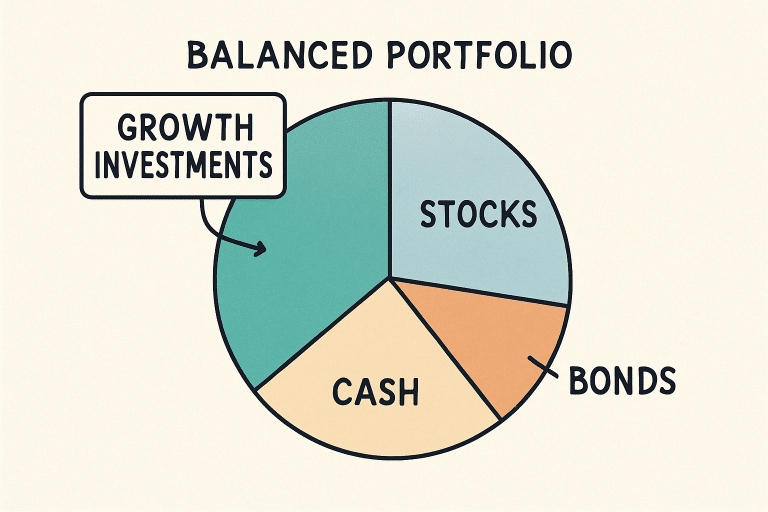

- Incorporating growth investments into a balanced portfolio can enhance potential returns while managing risk.

- Regular rebalancing and diversification are crucial for maintaining the desired risk-return profile.

Understanding Growth Investing

Growth investing focuses on identifying companies that demonstrate potential for above-average revenue, profit, or market share growth. Investors who adopt this strategy typically target stocks of firms that reinvest their earnings to drive further development—rather than those that pay out high dividends. The attraction lies in the expectation that the company’s value will rise significantly as it achieves milestones and meets ambitious goals. Learning about growth investing strategy is crucial for investors aiming to maximize their capital appreciation over time.

Growth companies can be found in a variety of sectors, including technology, healthcare, and consumer markets, and often introduce innovative products or services. These innovators tend to have business models that prioritize rapid scaling and agility over generating immediate profits. Due to their ambition and reinvestment, many of these stocks have outperformed the broader market over longer time frames, particularly in expansionary economic cycles.

By contrast, value investing, another popular strategy, focuses on finding stocks that are undervalued relative to their intrinsic worth. Understanding the fundamental differences between these strategies is crucial for anyone considering a diversified investment approach.

Benefits of Growth Investing

Allocating a portion of your portfolio to growth stocks brings several potential advantages:

- Potential for High Returns: Growth companies, by definition, experience above-average expansion, which can translate into significant capital appreciation for early and strategic investors.

- Inflation Hedge: Firms with robust growth prospects often have the flexibility to pass rising costs on to customers, ensuring their profitability keeps pace with inflationary pressures.

- Industry Leadership: Growth companies often establish leadership positions in evolving sectors, which may further enhance returns if industry trends accelerate.

Additionally, growth stocks frequently benefit from strong investor demand during favorable economic environments, further propelling their values. However, this advantage is best realized as part of a well-considered allocation strategy, rather than an all-or-nothing wager on a handful of companies.

Risks Associated with Growth Investing

While the upside can be compelling, growth investing also increases exposure to certain risks:

- Market Volatility: Growth stocks are often priced based on future expectations instead of current earnings. This forward-looking premium means they can experience sharp price swings as forecasts change or are missed.

- Overvaluation: The excitement surrounding fast-growing companies can lead to inflated stock prices. If the underlying business fails to sustain its aggressive growth rates, valuations may correct dramatically, resulting in significant losses.

- Sector Concentration: Some growth sectors can become overconcentrated within portfolios, increasing vulnerability to sudden sector-specific downturns.

Careful due diligence and disciplined asset allocation are key to mitigating these risks.

Strategies for Integrating Growth Investments

Successful integration of growth investing requires a plan tailored to your unique objectives and risk appetite. Consider these steps:

- Asset Allocation: Determine the optimal proportion of growth stocks in your portfolio, taking into account your timeline, liquidity needs, and ability to withstand market fluctuations.

- Sector Diversification: Rather than focusing solely on one industry, spread growth holdings across different sectors such as technology, healthcare, and consumer discretionary. This broadens opportunities and cushions against sector-specific volatility.

- Blend with Value and Defensive Assets: Balancing higher-growth holdings with value and defensive assets can help reduce the overall volatility of your portfolio and provide more stable returns during downturns.

Importance of Diversification

Diversification is the cornerstone of risk management. By spreading investments across different asset classes, industries, and even geographical regions, investors can mitigate the impact of underperformance in any single area. Including alternative assets, such as commodities or real estate, may also enhance returns and protect against inflation or currency risks. According to CNBC’s beginner guide, building a resilient portfolio means seeking exposure to a full spectrum of growth, value, and alternative investments.

Role of Rebalancing

Over time, the values of different assets fluctuate, leading to an unintended drift from your original asset allocation. Regular rebalancing—typically once or twice a year—brings your portfolio back in line with your strategy by trimming positions that have grown disproportionately and reinvesting in those that have lagged. This discipline helps lock in profits, control risk, and ensure your portfolio remains positioned for your long-term goals.

Monitoring and Adjusting Your Portfolio

Growth investing is dynamic—requiring ongoing attention to both portfolio performance and shifting market conditions. Regular reviews ensure your mix of growth stocks remains in line with your goals and that any underperforming investments are addressed promptly. Staying updated on global events, sectoral trends, and company news not only helps capture opportunities but also mitigates potential losses.

Final Thoughts

Integrating growth investing into a balanced portfolio can deliver substantial long-term rewards while effectively managing risk. With a focus on strategic allocation, regular rebalancing, and robust diversification, investors position themselves to participate in market upswings and weather downturns alike. A thoughtful and disciplined approach enables you to benefit from the innovation and expansion of leading companies—while maintaining a portfolio anchored by stability and resilience that aligns with your personal financial goals.